Money & Megatrends

December 1, 2025

By Brian Hunt

Inside today’s issue:

- Gold stocks are poised to break out to the upside. Are you positioned to benefit?

- Copper mining stocks stage a major upside breakout. The bull market in critical resources rolls on.

- The AI-fueled natural gas trade nears a major upside breakout

- One of the world’s most important AI companies soars to a new all-time high. An update on the great “AI Boom or AI Bust” debate.

Gold Stocks Are Poised to Break Out to the Upside. Are You Positioned to Benefit?

Break out, advance, consolidate.

Break out, advance, consolidate.

Rinse and repeat.

That is the classic behavior of a multi-year bull market. Prices move into new, higher territory (the breakout), the trend rallies and makes the longs a lot of money (advancement), and then the trend takes a breather, moves sideways, and digests the gains (consolidate).

Then it does it all over again… and again… and again. The life of an uptrend.

This is what gold stocks have been doing this year in the confines of a multi-year bull market and en route to an incredible YTD gain of 142%.

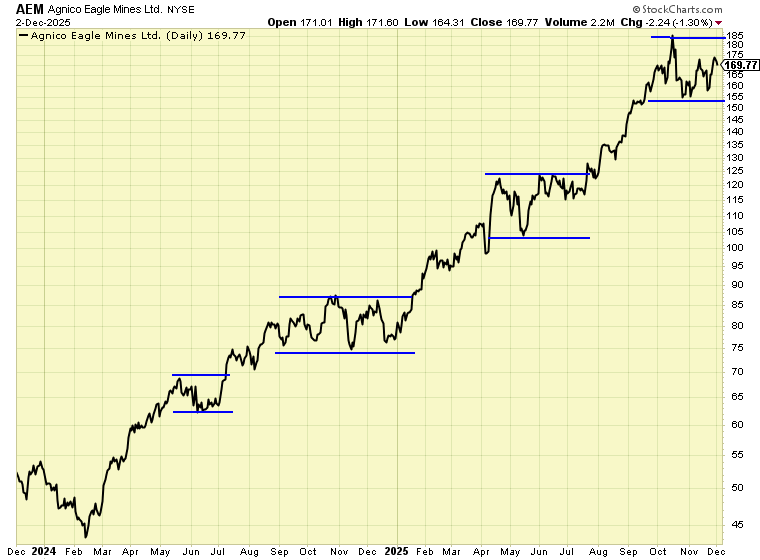

For example, look at gold mining blue chip Agnico Eagle Mines (AEM). It’s one of the highest quality gold miners in the industry.

The 2-chart below shows how AEM has played the “break out, advance, consolidate, then repeat” game to produce a 227% return since late 2023. The chart is a thing of beauty:

A beautiful uptrend

This trading pattern is not unique to AEM. The charts of many other gold miners look the same. Again, classic bull market behavior. Magnificent price action. Chefs kiss. Some people go to art galleries to see beauty. I see it in trends like this.

As you can see, AEM is currently in a consolidation phase. Many other gold stocks are as well. Will these consolidations be followed by yet more advancement?

My bet is yes.

I’ve been urging people to be heavily involved in gold and gold stocks for more than two years. It’s been a grand slam home run trade. Gold is up 106% since late 2023. This large increase in the gold price has produced correspondingly large increases in gold miner revenues and cash flows. It has essentially transformed the gold mining business.

At this point, gold mining firms don’t need gold to continue rising to generate strong revenue growth, profit margins, and share price gains. Gold could remain at its current level of $4,200 for years, and quality gold miners will remain cash flow machines, and their bull markets will continue. I’m staying long.

Copper Mining Stocks Stage a Major Upside Breakout. The Bull Market in Critical Resources Rolls On

The bull market in critical resource investments is alive and well. For evidence, let’s check in on the soaring copper mining sector.

Over the past three months, I’ve repeatedly made the case that we are entering a bull market in many critical resource sectors.

Critical resources are the building blocks of the economy. Think raw materials like crude oil, natural gas, iron ore, copper, corn, and cotton.

Even today’s high-tech world of AI, apps, email, and Zoom calls is built on a “low-tech” foundation of steel, oil, concrete, corn, wheat, copper, lumber, and aluminum. Mining, extracting, planting, harvesting, processing, refining, and transporting these vital resources is a multi-trillion-dollar business that affects every area of your life.

Many critical resource projects take 5 – 10 years to go from an idea on paper to producing raw materials. So, when a resource market trends in one direction, the trend tends to last for years.

Last year, we highlighted the bull case for copper and copper stocks:

Copper is widely used as a conductor to build power grids, data centers, power lines, and communication networks. When demand for power grids, renewable energy, and AI power usage booms, copper demand goes up. Plus, copper supply is constrained due to a lack of new discoveries.

Since our note, copper and copper stocks staged a large rally, one that was met with heavy selling in October. After that, copper stocks – as represented by the Global X Copper Miner ETF (COPX) – moved in a sideways consolidation pattern. Today, COPX broke out of that consolidation to reach a new 1-year high. The bull market in critical resources continues.

A Huge New Development in the Great “AI Boom or AI Bust” Debate

The AI bears took another one to the chin today.

ASML (ASML) stock just surged to an all-time high.

Over the past few months, we have frequently highlighted how “AI Boom or AI Bust” has become the world’s most important financial question.

Three years into the AI megatrend, major tech companies including Meta, Google, Amazon, OpenAI, and Microsoft are engaged in an epic race to develop the world’s best AI models and infrastructure. They are on pace to spend around $400 billion on AI infrastructure this year, with more than a trillion dollars coming behind it. It’s the largest infrastructure spending boom in world history.

Whether Big Tech’s massive investment pays off has become the world’s most important financial question.

AI bears say much of this spending is crazy. Big Tech won’t generate the revenues and profits required to justify it. Once the world realizes this, GDP growth will stall, and the stock market will crash.

AI bulls say, “AI is the most transformative innovation of the century. Big Tech leaders know what they are doing. The bears can’t fathom the amazing and profitable AI applications to come.”

Regular readers know we like to know both sides of any debate about the “fundamentals” of a megatrend. But what the market thinks of those fundamentals is far more important than either side’s beliefs.

Right now, the market prefers the bull case. Shares of AI semiconductor manufacturing equipment leader ASML soared to a new all-time high today.

ASML is the only company in the world that can currently create Extreme Ultraviolet Lithography (EUV) Machines. These EUV machines are used by semiconductor makers to build the most advanced AI chips in the world. This makes ASML one of the most important technology companies in the world.

ASML’s big move today is another sign that the market prefers the “AI Boom” thesis over the “AI Bust” thesis. This is the market saying, “Stay long cause the bears are wrong.”

ASML breaks out to a new all-time high

Market Notes

- Tech supergiant Apple (AAPL) reached a new all-time high today. The uptrend in technology stocks rolls on.

- Pharmaceutical giants Novartis (NVS) and Bristol-Myers Squibb (BMY) reached new 6-month highs today. The health care uptrend rolls on.

- High-horsepower engine maker Cummins (CMI) reached a new all-time high today. New highs for this economically sensitive company are a good sign for the global economy.

- The S&P Oil and Gas Equipment & Services ETF (XES) surged 3.9% today to reach a new 6-month high.

- Offshore oil drilling firm Valaris (VAL) reached a new 1-year high today.

- U.S. banking giant Citigroup (C) reached a new all-time high today.