Money & Megatrends

December 4, 2025

By Brian Hunt

Inside today’s issue:

- Our oil stock trade explodes higher… did you act and profit?

- An important new development for the U.S. economy: One of our critical “real world” indicators surges to a new high.

- Are you on board? Natural gas giant EQT breaks out to a new all-time high. The AI-fueled natural gas trade is leaving the station.

- Brazil powers to new highs. The bull market in critical resources marches on.

Our Oil Stock Trade Explodes Higher… Did You Act and Profit?

This week, the quiet rally in oil stocks got a little louder… and a lot more profitable.

On September 29, we highlighted the emerging leadership of oil and gas stocks and stated it’s time to be long this sector.

The bull case for oil stocks is simple. If the global economy is growing, oil demand will remain solid. However, importantly, U.S. shale oil production growth appears to be peaking. This would remove a critical and reliable source of production growth that has been in place for over a decade. Plus, oil is very cheap relative to gold and other assets, indicating good value in oil.

That’s the bullish forecast, but regular readers know we care a lot more about what the market thinks of fundamentals than the fundamentals themselves. You can believe in a bullish market forecast until you’re blue in the face, but if that market is moving lower, then your forecast isn’t worth much.

In the case of oil stocks, the market likes the bull case. Oil stocks have moved higher – a lot higher – this week. Yesterday, many of the market’s most important oil service stocks jumped more than 4% to reach new 6-month highs, including Valaris (VAL, offshore drilling), NOV (NOV, oil services), and Schlumberger (SLB, oil services).

The strength in individual names powered the S&P Oil & Gas Equipment & Services ETF (XES) to a substantial 4.8% gain on the day, which took the fund to its highest price since January. XES is up 15.8% since our initial note was issued.

Trends tend to persist and winning stocks tend keep to winning, so I expect this trend to run higher.

Oil service stocks power to new highs

An Important New Development for the U.S. Economy: One of Our Top “Real World” Indicators Surged to a New High

Well, that didn’t take long.

One day after I highlighted the transports and their potential breakout, they staged that breakout.

In our December 2 issue, we profiled the bull market in the iShares US Transportation ETF (IYT) and noted it was close to a major upside breakout. This breakout would be a bullish sign for the U.S. economy.

The iShares US Transportation ETF (IYT) is the market’s largest transportation-focused ETF. It owns a variety of companies involved in trucking, shipping, air travel, railroads, and transportation logistics. Think UPS, FedEx, Delta Air, Union Pacific, Norfolk Southern, and J.B. Hunt.

It’s fair to say IYT is a “highly economically sensitive” fund. This is because the toys, clothes, furniture, cars, building materials, devices, and food we buy must be transported. Railroads, air shippers, 18-wheelers, and delivery trucks serve as the circulatory system of the economy.

Common sense tells us that the components of IYT thrive when America is making things, buying things, and transporting things. The components of IYT do poorly when the opposite is true.

As you can see in the chart below, America is doing so much making, buying and transporting that the IYT surged 2.5% on Wednesday to reach a new all-time high. This is an important sign that the U.S. economy is doing better than pessimists would have you believe.

Show this chart to the apocalyptic financial gurus and ask them why they are right and the market is wrong. Bullish!

This is not bearish: Transports stage an important upside breakout

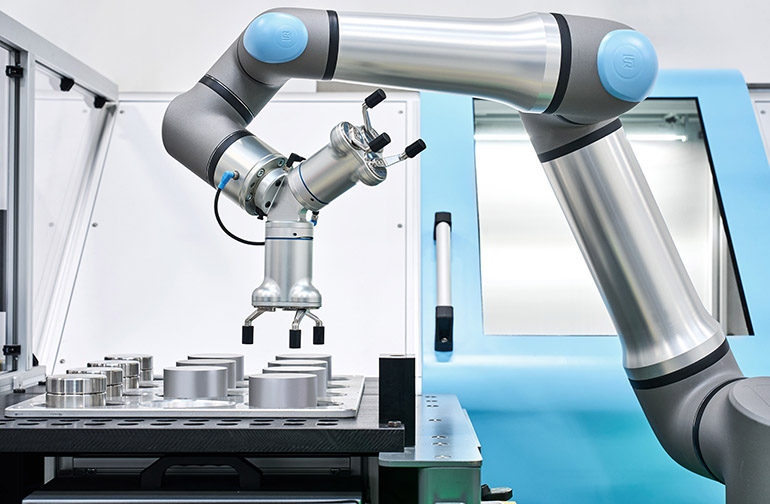

The Robotics Megatrend Continues to Yield Big Winners

This week, Teradyne (TER) broke out to a new all-time high. That’s a great sign for investors in the robotics megatrend.

Over the past 18 months, I’ve urged friends and colleagues to become heavily involved in the robotics megatrend. It is one of the biggest financial opportunities of our lives.

At Money & Megatrends, we occasionally trade and track trends that last less than 12 months. The robotics megatrend will last more than 12 years.

It is a massive, multifaceted trend that will transform the world. It will yield greater factory automation, surgical robots, autonomous cars, autonomous air taxis, humanoid worker robots, and much more. Robotics investment is expected to increase by at least 15% annually through the rest of this decade. Within five years, Amazon will utilize more robots than employees.

Teradyne, with a market cap of $31 billion, is near the top of many “best ways to invest in robotics” lists.

As my friend and master investor Eric Fry recently outlined:

Teradyne is a global leader in automated test equipment (ATE), essential for testing advanced chips in smartphones, AI servers, automotive electronics, and high-bandwidth memory (HBM)…

But Teradyne is also a fascinating robotics play, thanks to its savvy acquisitions of Universal Robots (UR) in 2015 and Mobile Industrial Robots (MiR) in 2018. Now that these acquisitions are well integrated into the company, Teradyne is producing industry-leading collaborative and mobile robots. In fact, the robot leader, Amazon, has begun deploying Teradyne’s UR-powered robotic arms in its Vulcan robot, which it touts as a revolutionary breakthrough in warehouse automation.

Eric’s research into Teradyne has been rewarding for readers of his Fry’s Investment Report. The stock is up more than 100% since his recommendation in July.

This week, Teradyne reached a 1-year high. It’s yet more evidence that robotics is a megatrend you want to be involved with.

A robotics leader powers to new highs

Market Notes

- This week, financial industry giants Wells Fargo (WFC), Citigroup (C), Goldman Sachs (GS), and Morgan Stanley (MS) reached new all-time highs. These firms are critical parts of America’s financial backbone. Their uptrends are positive signs for the U.S. economy.

- Industrial robotics firm Rockwell Automation (ROK) reached a new all-time high this week. It’s an indicator that the robotics megatrend is in full swing.

- Natural gas giant EQT (EQT) broke out to a new all-time high this week. The AI-fueled natural gas trade is leaving the station.

- Senior living facility operator Ventas (VTR) reached a new all-time high this week. It’s more evidence that the Boomer health care trend is a winner.

- Diversified mining giant Rio Tinto (RIO) broke out to an all-time high this week. This is further confirmation that critical resource investments are in a bull market.

- The iShares Brazil ETF (EWZ) climbed 1.4% today and reached a 1-year high. Shares are up 19% over the past three months.