Money & Megatrends

November 6, 2025

By Brian Hunt

Inside today’s issue:

- A stock that sits at the nexus of the robotics boom and the U.S. manufacturing boom

- A premier oil producer is on the cusp of a major upside breakout. Are you long oil yet?

- Very expensive, very wrong advice. The financial apocalypse gurus need to have yet another difficult conversation with themselves and their followers

- Global banks soar to new highs… AI threatens big tech stocks you might own

A Stock That Sits at the Nexus of the Robotics Boom and the U.S. Manufacturing Boom

I often say you want to work and invest in booming industries that are enjoying such strong revenue growth… such huge investment flows… and have so much future demand… that financially, you’re essentially running downhill.

When a megatrend is working in your favor, success comes easier. A megatrend turns a good idea into a great idea. It turns a big, expensive mistake into a tiny mistake. When a megatrend is working in your favor, even your morning coffee tastes better.

One of the only things better than having a megatrend working in your favor is to have two megatrends working in your favor.

This brings us to RBC Bearings (RBC).

RBC Bearings is one of America’s largest makers of ball bearings – critical components in complex machines such as aircraft engines and robots.

Regular readers know that the robotics megatrend is one of my highest conviction investment ideas. We are in the early innings of a robotics boom that will deliver advanced industrial robots, humanoid robots, autonomous vehicles, and autonomous air taxis.

Another megatrend I’m bullish on is the buildout in U.S. manufacturing capacity. Donald Trump and many business leaders believe that American economic security depends greatly on increasing the country’s manufacturing base. More than a trillion dollars is set to flow into this megatrend.

At the nexus of these trends are companies that make critical components for industrial machines and robotics. Demand for their products is beginning to boom. RBC Bearings is one such company.

But don’t take my word for it. Take the market’s word for it.

RBC currently sports top-tier earnings growth and is starting to catch the attention of investors who want to position themselves in the megatrends outlined above. These factors just boosted RBC to a new 1-year high. Count me as bullish.

Leading ball bearings maker RBC reaches a new 1-year high.

A Premier Oil Producer Is on the Cusp of a Major Upside Breakout. Are You Long Oil Yet?

On September 29, I highlighted the emerging leadership of oil and gas stocks and covered the bull case for this sector, which can be summed up like this:

If the global economy is growing, oil demand will remain solid. But, importantly, U.S. shale oil production growth looks like it is peaking. This would remove a reliable source of production growth that has been in place for over a decade. Plus, oil is very cheap relative to gold and other assets, indicating good value.

The bull case for oil stocks is being bolstered by the market leadership of Canadian oil giant Suncor Energy (SU).

Suncor is one of North America’s largest oil producers. But, unlike many oil companies, Suncor does not spend big bucks searching for oil on the Texas plains or drilling with offshore platforms.

Instead, Suncor operates in Canada’s enormous oil sands region… where hydrocarbons sit in “muck” near the ground surface. They are extracted with giant mining shovels and with “in situ” mining (pronounced by some as in-SIT-too).

In situ extraction involves inserting pipes into the ground, injecting steam into them, and extracting hydrocarbons through the pipes. This makes Suncor’s business more like running a factory than wildcatting with drill rigs.

Given Suncor’s relatively stable business model and enormous size, it is a “go-to” stock for large investors who want to take a position in the oil sector.

As you can see in the chart below, Suncor is enjoying increased investor money flows that are pushing the stock higher. It’s a chip shot away from a new 1-year high. I bet this trend continues.

A blue-chip oil producer and its uptrend

Very Expensive, Very Wrong Advice. The Financial Apocalypse Gurus Need to Have Yet Another Difficult Conversation With Themselves and Their Followers

Since the current bull market began in 2023, a whole doom-and-gloom media industry has developed, built on bearish stock forecasts and recession forecasts.

Anyone who listened to the “prophets of the apocalypse” and avoided stocks has missed a historic wave of wealth creation. The doomers may sound clever and are often well-meaning, but they consistently prove to be wrong. Following their advice has proven to be very costly in terms of opportunity missed.

Over the past year, I’ve consistently cited market moves that have made hash out of the bears’ apocalyptic warnings. There are the soaring market values of big banks, heavy equipment maker Caterpillar, U.S. manufacturing stocks, and now, engine maker Cummins (CMI).

Cummins is one of the world’s largest makers of high-horsepower engines that power bulldozers, heavy trucks, excavators, and tractors. Its fortunes rise and fall with the world’s ability to fund infrastructure and transportation projects.

Cummins is one of my favorite economic indicators. Regular readers know that I place much more value on stock market prices than I do on economic forecasts. The fresh all-time high of one of the world’s most important manufacturing companies tells me that, despite some negatives, the economy continues to power along. It shows that “building things” is in a clear megatrend.

Show the all-time highs below to your local bear and ask them why they are right and the market is wrong. Their advice this year has been wrong and costly.

Not financial apocalypse… more like a major uptrend

Market Notes

- Major global banks HSBC (HSBC), Barclays (BCS), and Lloyds Banking Group (LYG) climbed to new 1-year highs today. Can the global economy be all that bad if its major banks are doing great?

- Giant Latin American banks Banco Bilbao (BBVA), Itau Unibanco (ITUB), and Banco Santander Brasil (BSBR) reached new 1-year highs today. This is confirmation that Latin American stocks are in a strong uptrend.

- Graphic design software giant Adobe (ADBE) reached a new 1-year low today. Bears on the stock say low-priced, AI-powered design programs threaten the business.

- Language learning technology firm Duolingo (DUOL) plummeted 27% to a 1-year low today. Same as Adobe (see above).

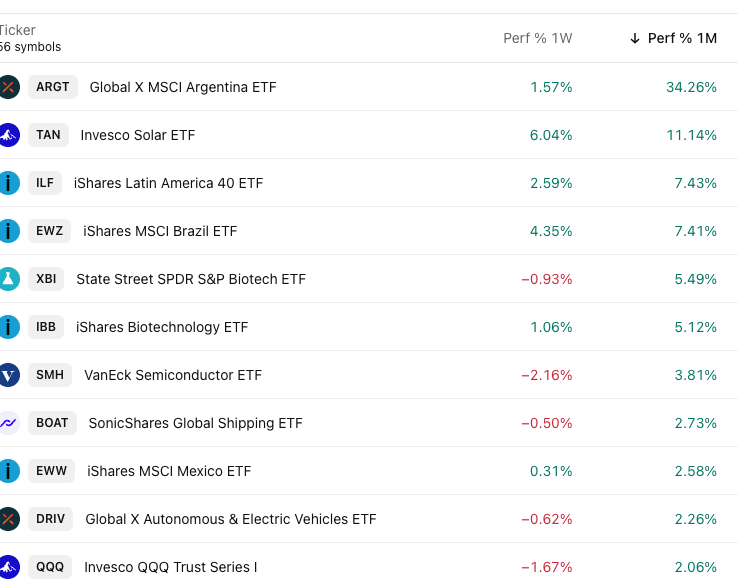

Market Trend Power Rankings

Top performing themes and trends over the past month