Money & Megatrends

October 20, 2025

By Brian Hunt

Inside today’s issue:

- AI Boom or AI Bust? Answering the most important economic question in the world.

- The stealth bull market in genomics is now creating winners at an awesome rate. Are you benefiting?

- One of our top “Trump & Friends” trades continues to lead the market

AI Boom or AI Bust? Answering the World’s Most Important Stock Market Question

In late 2022 – before Chat GPT was released to the public – I began telling friends and colleagues that AI was about to explode into public awareness. Shortly after, AI did just that, marking the beginning of one of the biggest investment themes of our lives.

Now, more than two years into this super boom, big tech companies Meta,Google, Amazon, OpenAI, and Microsoft are engaged in an epic race to build the world’s best AI models and infrastructure. This year, they are on pace to spend around $400 billion on AI infrastructure, with more than a trillion dollars coming behind it. It’s the largest infrastructure spending boom in world history.

Whether Big Tech’s massive investment pays off has become the most important issue in the stock market.

AI bears say much of this spending is madness. It won’t generate the revenues and profits required to justify it. Once the world realizes this is the case, GDP growth will stall, and the stock market will crash.

AI bulls say, “AI is the most transformative innovation of the century. Big Tech leaders know what they are doing. The bears can’t fathom the amazing and profitable AI applications to come.”

Regular readers know we like to know both sides of any debate about the “fundamentals” of a megatrend. But what the market thinks of those fundamentals is far more important than either side’s beliefs.

You can track and trade what the market thinks of the great “AI Boom or Bust” debate with the VanEck Semiconductor ETF (SMH). This fund owns the world’s largest and most important chip companies, including AI giants Nvidia (NVDA), Taiwan Semiconductor (TSM), and Broadcom (AVGO).

If the AI bulls are right, this fund goes way higher. If the AI bears are right, this fund goes way lower. As you can see in the chart below, the market likes the bull case. Today, SMH broke out to new all-time highs, with the market saying, “Stay long cause the bears are wrong.”

We plan to frequently show you what’s happening with SMH. It’s one of the most important charts in the world… and it’s going to let us know who is right in the great “AI Boom or AI Bust” debate.

No AI bust here… just a powerful uptrend

The Stealth Bull Market in Genomics Is Now Creating Winners at an Awesome Rate. Are You Benefiting?

Over the past month, we’ve frequently highlighted the emerging megatrends in health care, biotechnology, and genomics. More and more, it appears health care and drug development will be among the leading sectors of the next few years.

The bull case here is simple and powerful: The Baby Boom generation represents the largest group of rich people in recorded history. The boomers that aren’t rich are supported by the government. As this massive generation ages, they will spend tsunamis of money on health care and longevity.

If the trend tailwinds are set to blow for the health care sector, the genomics subsector should do very well.

Genomics is the science of analyzing human DNA – often referred to as the “software code of life” – to create medicines and treatments.

Years of innovation in this field have us on the brink of creating customized treatments based on an individual’s DNA… and even “editing” genes to cure disease.

Bulls on this sector highlight that AI could turbocharge its progression, making genomics one of most promising fields in all of health care… one with trillion-dollar+ implications.

One way to track and trade the genomics theme is the ARK Genomic Revolution ETF (ARKG). It owns a basket of bleeding-edge genomic companies. Its largest holding, Tempus AI (TEM), is often cited as a premier way to play “AI in health care.” ARKG also holds large positions in gene-editing companies CRISPR (CRSP) and Intellia (NTLA).

Today, the market sent a very strong signal that the genomics trend is one you want to be involved in. ARKG exploded 8% higher to reach a new 52-week high.

This winning theme isn’t making front-page news yet; it is still very much in a “stealth bull market.” The people on the sideline will likely provide buying fuel as this rally runs higher.

The Genomics Uptrend Reaches a New High

One of Our Top “Trump & Friends” Trades Continues to Lead the Market

On the topic of stealth bull markets the public is largely unaware of, the psychedelics trend continues to be a market leader.

On September 29, I highlighted psychedelics stocks as a big potential “Trump & Friends” financial opportunity.

I can’t remember a presidential administration that helps me make money like Trump & Friends does. Whether you like them or not, there’s no denying these guys make stocks move.

Since Trump took office in January, his moves have sent rare earth mining stocks soaring. He has helped support the AI trade, contributing to a 48% increase in Intel stock in two months. Trump’s support for crypto has helped generate big gains in that sector.

Psychedelics may be next.

Over the past decade, psychedelics-based treatments have gained a lot of support in the mental health world… and some slowly changing support from the government and universities.

Supporters say psychedelics are a big help in treating addiction and trauma. One such supporter is Secretary of Health and Human Services, Robert F. Kennedy, Jr., who is rumored to be preparing more government backing for psychedelics.

This trade is off to a great start. The psychedelics fund AdvisorShares Psychedelics ETF (PSIL) is up 13% since our note. Today the fund hit a new 52-week high. Psychedelics leader ATAI Life Sciences (ATAI) recently hit a new 52-week high. I remain long this unique “Trump & Friends” trade.

Market Notes

- Gold continued its market leadership today. The yellow metal is within a whisker of its all-time high near $4,400 per ounce.

- European blue chips continued their uptrend. Today, the SPDR Euro STOXX 50 ETF (FEZ) powered to a new 52-week high.

- Genomics leader Natera (NTRA) reached a new 52-week high today.

- Long live the Mag 7! Apple (AAPL) powered to a new all-time high today. The iPhone maker may be ready to start an AI-fueled rally.

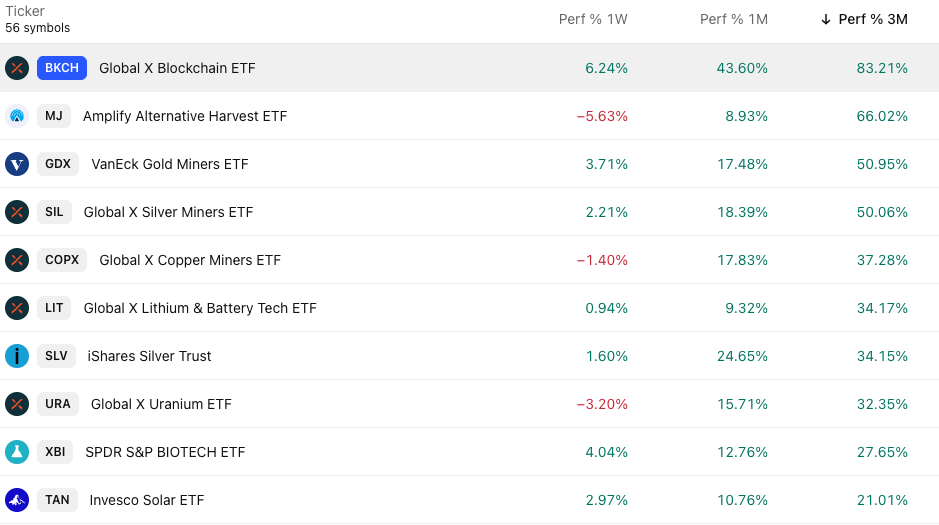

Market Trend Power Rankings

Top performing themes and trends over the past 3 months