Money & Megatrends

October 9, 2025

By Brian Hunt

Inside today’s issue:

- Did you get in? Silver, psychedelics, robotics, cannabis, biotech, drones, and critical resources soar higher.

- Is the AI boom about to blow up? Here’s where you get the answers…

- Editing and coding the “software of life” becomes an emerging megatrend.

- Megatrend update: How to partner with the U.S. Government and make a lot of money.

Is the AI Boom About to Blow Up? Here’s Where You Get the Answers…

In late 2022 – before Chat GPT was released to the public – I began telling friends and colleagues that AI was about to explode into public awareness. Shortly after, AI did just that and one of the biggest investment themes of our lives was born.

More than two years into this super boom, big tech companies Meta, Google, Amazon, OpenAI, and Microsoft are locked in an epic contest to build the best AI models and infrastructure. They are on pace to spend around $400 billion on AI infrastructure this year… with more than a trillion dollars coming behind it. It’s the largest cap ex boom in history.

What Big Tech ends up getting from its enormous AI investment has quickly become one of the most important issues in the world.

AI bears say much of this spending is madness. It won’t generate the revenues and profits required to justify it. Once the world realizes this unfortunate situation, GDP growth will stall and the stock market will crash.

AI bulls say, “Build it and they will come. Big tech leaders know what they are doing. The bears can’t fathom the amazing and profitable AI applications to come.”

Regular readers know we like to know both sides of any debate about a market’s “fundamentals”… but what the market thinks of those fundamentals is far more important than either side’s beliefs.

You can track what the market thinks of the great “AI Boom or Bust” debate with the big semiconductor fund SMH. This fund owns the world’s largest and most important chip companies. AI giants Nvidia, Taiwan Semi, and Broadcom are major holdings.

If the AI bulls are right, this fund goes way higher. If the AI bears are right, this fund goes way lower. As you can see from the chart below, the market likes the bull case. This week, SMH broke out to new all-time highs. The market is saying, “Stay long ’cause the bears are wrong.”

In the months ahead, I plan on frequently showing you what’s happening with SMH. It’s one of the most important charts in the world… and it’s going to let us know who is right in the great “AI Boom or Bust” debate.

No AI bust here… just a big uptrend

Editing and coding the “software of life” becomes an emerging megatrend

This week, we pointed to the new upside breakout in health care stocks (XLV) as evidence the “Baby Boomer health care” theme is beginning to pay off in the market.

If the trend tailwinds are set to blow for the health care sector, the genomics subsector should do very well.

Genomics is the field of analyzing human DNA – the “software code of life” – to create medicines and treatments.

Years of innovation in this field have us on the brink of being able to create customized treatments based on an individual’s DNA… and even “editing” genes to cure disease.

Bulls on this sector like to point out how AI could turbocharge its progression. This all makes genomics one of the most promising fields in all of health care… one with trillion-dollar+ implications.

One way to track and trade the genomics theme is the ARK Genomic Revolution fund (ARKG). It owns a basket of bleeding-edge genomic companies. Its largest holding – Tempus AI (TEM) – is often cited as a premier way to play “AI in health care.” ARKG also holds large positions in “gene editing” companies CRISPR (CRSP) and Intellia (NTLA).

As you can see from the chart below, the market is starting to like the genomics theme. ARKG is up 26% in the past month and just broke out to a new 12-month high. We bet this theme keeps running.

Genomic stocks break out to new highs

Megatrend update: How to partner with the U.S. Government and make a lot of money

In a research note early this year, I detailed how there’s a new way to partner with the U.S. government and make a lot of money.

My megatrend thesis goes like this: Donald Trump has staked his legacy and reputation on massively expanding U.S. manufacturing capacity. The Trump & Friends administration is working with business leaders to invest trillions in pursuit of this goal.

However, there’s a big problem with any plan to increase domestic manufacturing capacity: We don’t have the critical resources we need to build the required infrastructure.

We don’t have the copper, iron ore, rare earths, lithium, antimony, nickel, and other vital building blocks required to build all those data centers… all those factories… all those robots… all those electric grids… all those power plants… and so on.

It’s like we very much want to build a big house… but we don’t have the lumber, the screws, or the nails we need to make it happen. Solving this problem is possible…and it is an enormous financial opportunity.

To ensure we have the critical resources to build trillions of dollars in infrastructure, the U.S. government will change any law, kill any regulation, and write any check that will lead to more production.

This means that after more than 30 years of the U.S. government being hostile to domestic mines and mineral processing facilities, it is now supporting them. Trump can’t have his big manufacturing dream without them.

Mining investors and entrepreneurs are now operating in an incredible new era… one where the U.S. government is their best friend. It means the critical resource industry will most likely generate dozens of huge stock market winners… helped massively by its powerful, big spending partner.

This isn’t some wild forecast. It’s a trend that is playing out right now. Shares of U.S. Antimony just climbed 12% to reach a new 52-week high. The stock is up an incredible 293% since we highlighted this theme.

Antimony is a critical resource used to make batteries, acting as a hardener to improve their performance and durability. It is also used as a flame retardant and in the defense industry for things like explosives and night vision gear. U.S. Antimony is an antimony processor working with the U.S. government to increase supplies.

Then there’s rare earth play USA Rare Earths (USAR). It’s up 122% since my original note. Critical minerals play NioCorp (NB) is up 237%. Copper company Trilogy Metals (TMQ) is up 363%.

These returns were generated in less than four months.

We stand by our original thesis: Partnering with the U.S. government to increase domestic and friendly-country supplies of critical resources will prove to be one of the most lucrative financial activities of this decade.

Partnering with the government works: U.S. Antimony soars to a new high

Market Notes

-

Back in December, we urged readers and colleagues to get long the autonomous military and surveillance drone megatrend.

Since then, this theme has generated incredible gains. Today, leading drone maker Kratos (KTOS) climbed 5% to reach a new all-time high.

Up 303% since our initial note. -

Over the past year, we’ve pounded the table and then some on the robotics theme. This is an “inevitable” trend I am betting big on.

Today, leading robotics firm Symbotics (SYM) reached a new 52-week high. -

The biotech theme we’ve highlighted many times recently continues to pay off… the small cap biotech fund

(XBI) just reached a new 12-month high. -

The psychedelics theme we highlighted on September 29 continues to run higher.

The Psychedelics ETF (PSIL) just registered a fresh 12-month high. -

The silver trade we highlighted earlier this year is powering to new highs. Silver just broke out to a new high

in the $49 per ounce area. Silver is up 68% YTD. -

The cannabis trade I highlighted on August 5 is up an incredible 81% in less than three months.

The cannabis sector (MJ) is rallying hard on the belief that the Trump administration will relax regulations on the industry.

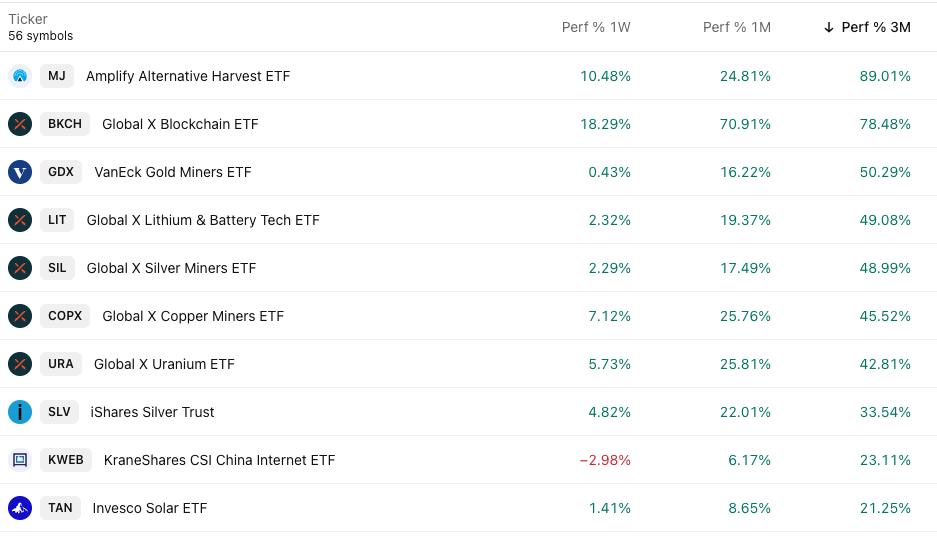

Market Trend Power Rankings

Top performing themes and trends over the past 3 months