Money & Megatrends

November 10, 2025

By Brian Hunt

Inside today’s issue:

- This off-the-radar AI power bet is poised to run higher

- The trend tailwinds are blowing with gale force for the Boomer health care theme

- Solar energy stocks continue their market leadership

- The AI Boom trend continues its remarkable run higher

This Off-the-Radar AI Power Bet Is Poised to Run Higher

Last month, the U.S. became the first country in history to export 10 million metric tonnes of liquified natural gas (LNG) in a single month.

This is promising news for the natural gas trade we introduced on October 2nd.

In my original note, I detailed how some of the world’s top investors view the U.S. natural gas industry as a great way to capitalize on AI’s power consumption boom.

The bull case for natural gas and AI goes like this: To support its huge AI ambitions, big tech is poised to build dozens upon dozens of power-hungry data centers over the next five years. This will drive increased demand for natural gas, which is the preferred clean-burning fuel for many power plants. Growing European demand for U.S. natural gas exports (to be less dependent on Russia) is also poised to be a big natural gas demand driver.

With this backdrop in mind, some of the world’s most informed hedge funds have taken positions in major American natural gas producers, including EQT (EQT), Range Resources (RRC), Antero Resources (AR), and Expand Energy (EXE). These stocks could double, then triple, over the coming years as AI and Europe act as strong consumption drivers.

As you can see from the chart below, the market is starting to like this trade. Shares of giant natural gas producer EQT are in a long-term uptrend and are close to new all-time highs. The charts of the other natural gas names look similar. I bet this trend continues.

Natural gas stocks are poised to reach new highs

The Trend Tailwinds Are Blowing With Gale Force for the Boomer Health Care Theme

Over the past few weeks, many sectors and themes have suffered alongside the broad market averages, declining by 4% to 10%. Decliners included the space, psychedelics, robotics, and quantum computing sectors.

The pharmaceutical sector, however, remained strong.

Over the past few weeks, the pharmaceutical industry – which has the Boomer health care megatrend working in its favor – ran to new all-time highs.

More than 10,000 Americans reach retirement age every day. That’s the giant Baby Boom generation entering the later stages of life… and a significant opportunity for the health care industry.

Ever since the Boomers hit the scene in 1946, they have been a demographic force to be reckoned with. As they’ve worked through life, they have powered a variety of big industry booms. For example, when Baby Boomers began buying starter homes in the 1980s, it drove big real estate bull markets in many cities.

Now, Boomers are in a phase of life where health care and longevity spending skyrocket. For many boomers, a typical month involves going to see at least one doctor to have something looked at, something removed, or something treated.

This means many health care fields are enjoying huge demand now… and will for at least the next decade. It’s going to rain money on many health care businesses.

Over the past month, I’ve highlighted how the market is beginning to like the Boomer health care theme. Health care and drug development stocks are starting to lead the market.

The past week’s trading has delivered more confirmation of this “bull thesis” in the form of new all-time highs for the iShares U.S. Pharmaceuticals ETF (IHE). This fund holds the “who’s who” in pharmaceuticals. Major holdings include Eli Lilly (LLY), Johnson & Johnson (JNJ), and Merck (MRK).

Given the long-term nature of the Boomer health care theme, we expect to see it generate many more such new highs over the coming years.

It’s a bull market in taking pills

Market Notes

- The iShares Brazil ETF (EWZ) reached a new 1-year high today. This provides more confirmation that the critical resources uptrend is alive and well.

- Giant Latin American banks Banco Bilbao (BBVA), Itau Unibanco (ITUB), and Banco Santander Brasil (BSBR) reached new 1-year highs today, confirming that Latin American stocks are in a strong uptrend.

- The solar trade we introduced on September 23 is off to an incredible start. Shares of the Invesco Solar ETF (TAN) reached a new 1-year high today. Shares are up 18% in less than two months.

- AI semiconductor leader Micron (MU) climbed to a new all-time high today. The AI Bulls continue their winning streak.

- Shares of tech supergiant Google (GOOG) reached an all-time high today.

Regards – and remember – trends tend to persist.

Brian Hunt

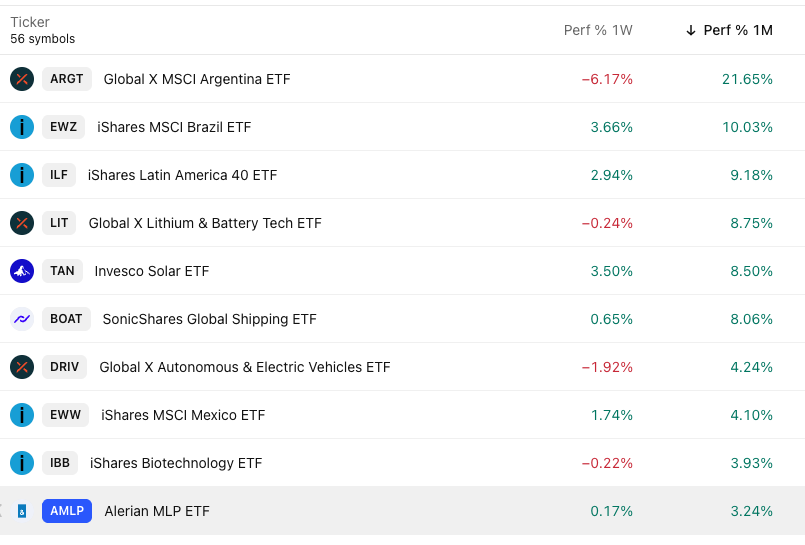

Market Trend Power Rankings

Top performing themes and trends over the past month