Money & Megatrends

October 15, 2025

By Brian Hunt

Inside today’s issue:

- Nuclear power blue chip Constellation Energy stages a massive upside breakout and confirms the AI Power theme is filled with opportunity.

- Small-cap stocks stage a major upside breakout. They are a buy.

- After soaring 51% this year, gold is due for a significant correction.

- The space and solar themes continue their wealth-creating market leadership.

- Our air taxi call leads to a 40% gain right out of the gate.

Another Breakout Confirms That AI Power Theme Is Filled With Opportunity

Regular readers know power consumption is one of the AI megatrends’ largest and most profitable facets. Given AI’s enormous promise, the world’s largest and wealthiest companies are embarking on the biggest capex spending cycle in history. Giants such as Google, Meta, Microsoft, and OpenAI are spending hundreds of billions of dollars on data centers, AI chips, and other infrastructure components.

All that AI infrastructure is poised to consume vast amounts of electricity. We quote the International Energy Agency:

“… electricity demand from data centres worldwide is set to more than double by 2030 to around 945 terawatt-hours (TWh), slightly more than the entire electricity consumption of Japan today. AI will be the most significant driver of this increase, with electricity demand from AI-optimised data centres projected to more than quadruple by 2030.”

To meet this demand, AI companies and their electric power providers are spending a lot of money on expanding nuclear power capacity. Nuclear can provide a lot of “always on, always there” carbon-free baseload power. Bloomberg reports that surging demand will drive $350 billion in nuclear spending in the U.S. by 2050.

I often say you want to live and invest in areas of the economy where it is raining money. You want to work and invest in super booms where money flows freely.

The nuclear power industry is one such area. For evidence of this, we present the new all-time high in Constellation Energy (CEG), the largest producer of carbon-free electricity in the U.S. The bulk of its production comes from nuclear plants. Constellation has signed major deals with Meta and Microsoft to power their data centers in the future. These attributes make Constellation one of the “go-to” stocks for hedge funds when they want to bet on the AI Power theme.

It’s raining money for AI Power theme plays

Small-Cap Stocks Stage a Major Upside Breakout — They Are a Buy

Over the past six months, some smart people have said small-cap stocks are poised to generate big returns. It looks like they are finally getting what they want.

It all comes down to interest rates.

Since the current bull market began around May 1, 2023, small-cap stocks (IWM) have lagged large-cap stocks (SPY, QQQ). IWM is up 46%, SPY is up 64%, and QQQ is up 88%.

The small-cap bulls say these stocks have underperformed large caps because high interest rates and high inflation hit small companies harder than large companies. This underperformance has left small caps relatively cheap, trading at a forward P/E ratio of 15, compared to the S&P’s 23.

If Donald Trump gets his wish of lower interest rates, however, small caps could become much less cheap. Lower rates should benefit small caps more than large caps.

Regular readers know I believe it’s good to know the fundamentals, but they are much less important than what the market thinks of those fundamentals. Fundamentals ride in the backseat. Price drives the car. You can be bullish on a theme until you’re blue in the face, but you have a losing idea if the market isn’t moving in your preferred direction.

Fortunately for small-cap bulls, the market is moving in their direction. The market believes Trump will get his rate cuts. This week, the small-cap group (IWM) we follow hit a new 52-week high. It’s time to be long small caps.

This trend is your friend: Small-cap stocks stage an important upside breakout

After Soaring 51% This Year, Gold Is Due for a Significant Correction

Today, gold is continuing its impressive 2025 run. The yellow metal is up 51% YTD.

I’ve made a lot of money in gold this year… although I didn’t want to.

I like to think of gold as a form of insurance… much like car and home insurance. You buy car insurance and hope to never use it, and you buy home insurance and hope to never use it.

Gold is my “wealth insurance.” I own gold and hope I never use it, and I hope the price does not go up.

I’m one of the most bullish and optimistic people on the U.S. economy you’ll ever meet. I believe the U.S. is the most dynamic and innovative economy on the planet. However, anything can happen.

Although I run a generally bullish portfolio, I like to own “wealth insurance” in physical gold, gold stocks, and physical silver.

I view gold as wealth insurance because gold typically performs well when the U.S. government is rapidly debasing the dollar, which is also known as “creating high inflation.”

When the dollar’s value is going to hell, it typically coincides with economic chaos and sinking stock prices. So, gold often zigs when stocks and bonds zag. I’d rather see gold “zig” to the downside for the rest of my days. This would mean we are in a good economic climate.

But as the old saying goes, wish in one hand and c**p in the other and see which one fills up faster. Gold isn’t going down this year. It is skyrocketing.

This is the byproduct of an unfortunate situation. Contrary to what the government claims, the U.S. dollar has lost tremendous value over the past six years. I estimate the dollar has lost at least 33% of its value since 2018. Prices seem so high… because the value of our money is so low.

Over the past 50 years, the U.S. government has promised too many things to too many people. It is struggling under a giant burden of debt and unfunded liabilities. These debts and liabilities cannot possibly be paid with sound, honest money. They can only be paid for with ever-increasing amounts of debased, diluted money, which is producing major currency debasement (aka inflation).

As a result, individuals and whole countries are buying vast amounts of gold to protect their savings.

As bullish as I am on gold over the long term, I believe it’s due for a significant correction. No market, no matter how strong, runs higher in a straight line. Markets are like runners. They can’t run flat out for miles. They must take breathers along the way.

You can see how hard gold has been running by looking at its 42-day rate of change (ROC).

ROC is an indicator that measures the price change of an asset between the current price and the price a specific number of days ago. ROC can be applied to any number of days.

If a stock has appreciated 20% over the previous 30 days, its 30-day ROC is 20%. If a stock has declined 40% over the previous 60 days, its 60-day ROC is -40%.

The ROC indicator is typically displayed in an additional “pane” in a price chart. It shows the ROC fluctuating around the “zero line.”

As you can see in the chart below, gold’s current 42-day (2 months of trading) ROC stands at 24%. It’s the highest 42-day ROC in over 4 years.

Given gold’s extraordinary short-term run to the upside, don’t be surprised to see traders take profits here and send it below $4,000 for a while.

Gold’s 42-day ROC reaches a multi-year high

Market Notes

- The solar energy trade we introduced on September 23 continues to trend higher. The solar energy ETF (TAN) we follow gained more than 4% today and reached a new 12-month high.

- Uranium stocks continued their huge 2025 run today. The uranium miner group we follow (URA) gained more than 5% today to reach an all-time high.

- Belief in the crypto bull market sent the blockchain group we follow (BKCH) to a new all-time high today.

- Over the past year, we’ve pounded the table on the robotics theme. The leading robotics ETF (ARKQ) reached a new 52-week high today.

- The “Space Trade” we highlighted on September 22 is running higher. The Ark Space fund (ARKX) just reached a new all-time high. Stay long space.

- Our June 26 bullish note on air taxis is proving timely. Archer Aviation (ACHR) broke out to a new 52-week high, up 40% since our note.

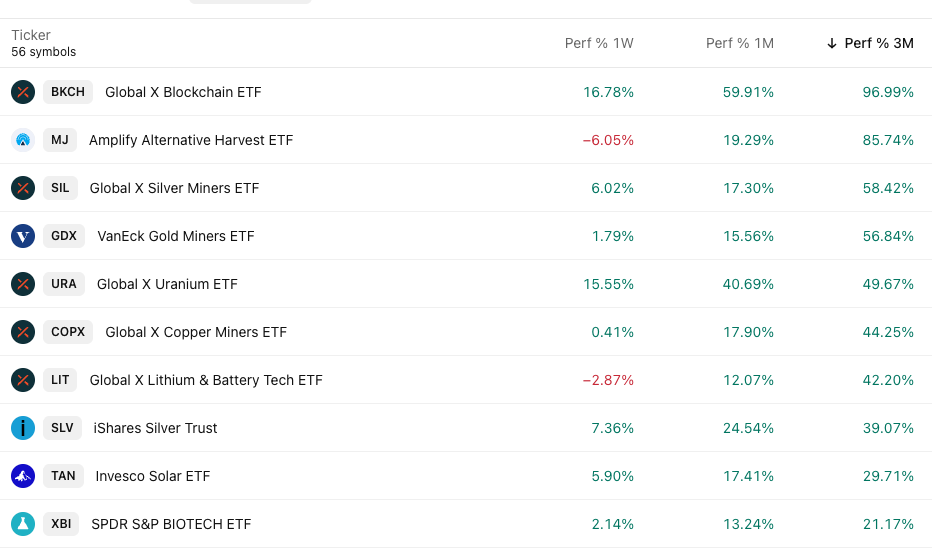

Market Trend Power Rankings

Top performing themes and trends over the past 3 months