Money & Megatrends

November 3, 2025

By Brian Hunt

Inside today’s issue:

- Amazon’s big AI deal propels it to a new high and confirms the “AI Boom” megatrend

- Did you read, act, and profit? The solar energy megatrend posts another new high

- Brazil reaches new highs… critical resources continue to be an area of opportunity

- The “humanoid robots” theme reaches a new high

Amazon’s Big AI Deal Propels it to a New High and Confirms the “AI Boom” Megatrend

This morning, leading AI firm OpenAI announced it has struck a new multi-year $38 billion partnership with Amazon. The deal will see OpenAI run its AI computing programs on Amazon’s cloud computing platform. Amazon stock jumped 5% on the news and reached a new all-time high.

Amazon stock’s big move is yet another win for the “AI Boom” thesis.

Over the past month, we have frequently highlighted how “AI Boom or AI Bust” has become the world’s most important financial question.

More than two years into the AI megatrend, big tech companies Meta, Google, Amazon, OpenAI, and Microsoft are in an epic race to develop the world’s best AI models and infrastructure. They are on pace to spend around $400 billion on AI infrastructure this year, with more than a trillion dollars coming behind it. It’s the largest infrastructure spending boom in world history.

Whether Big Tech’s massive investment pays off has become the world’s most important financial question.

AI bears say much of this spending is crazy. Big Tech won’t generate the revenues and profits required to justify it. Once the world realizes this, GDP growth will stall, and the stock market will crash.

AI bulls say, “AI is the most transformative innovation of the century. Big Tech leaders know what they are doing. The bears can’t fathom the amazing and profitable AI applications to come.”

Regular readers know we like to know both sides of any debate about the “fundamentals” of a megatrend. But what the market thinks of those fundamentals is far more important than either side’s beliefs.

Amazon’s huge move today is another sign that the market prefers the “AI Boom” thesis over the “AI Bust” thesis. This is the market saying, “Stay long cause the bears are wrong.”

Did you read, act, and profit? The solar energy megatrend posts another new high

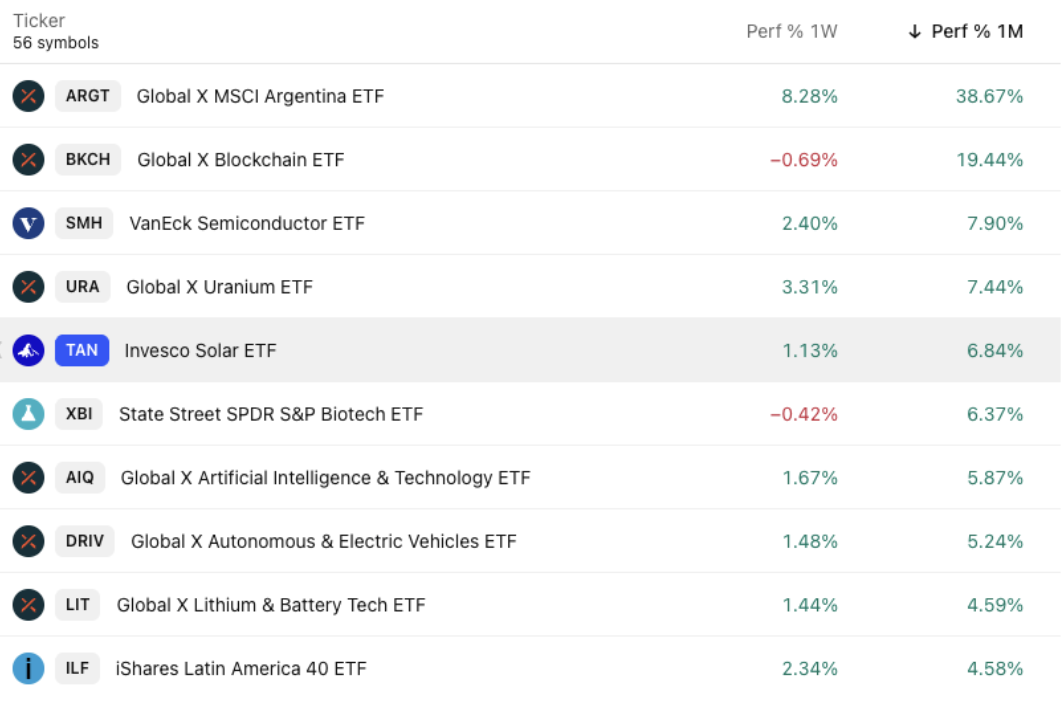

Of all the analytical tools I have at my disposal, few of them are as helpful as our Global Trend Tracker. This database tracks 75 ETFs that represent every major asset class, stock market, and theme on the market.

Today, the Global Trend Tracker shows – to no regular reader’s surprise – that it’s a bull market in solar energy stocks.

In our September 23 issue, we made the case for owning solar.

The power consumption theme is one of the AI megatrends’ largest and most profitable facets. Industry experts believe solar energy can’t compete with nuclear and fossil fuels to supply the enormous amounts of “always on, always there, baseload” power needed for AI data centers. However, inexpensive and easily installed solar systems can supply smaller individual power consumers, such as homes, offices, stores, and small factories.

That’s the fundamental case.

But around here, the fundamentals of a trend are less important than what the market thinks of a trend. Right now, the market likes the bull case for solar stocks. Today, the Invesco Solar ETF (TAN) broke out to a new 12-month high. Shares of TAN are up an impressive 19% in the past two months.

One unique thing makes me extra interested in solar stocks. There’s a pervasive belief that Trump & team are not supportive of solar energy. The U.S. government is phasing out some important financial incentives that support solar energy. Yet… solar stocks continue to rise.

When an industry group rises during a time it seems it should not, then you have a powerful uptrend on your hands. That’s what’s happening in solar right now… yet the public is different. Count me bullish.

Brazil reaches new highs… and critical resources continue to be an area of opportunity

We are officially in a bull market for critical resources. For proof, see today’s new high in Brazilian stocks.

Over the past two months, I’ve made the case that we are in a favorable environment for critical resources … one in which many individual resource sectors will generate strong returns.

Critical resources are the building blocks of the economy. Think raw materials like crude oil, natural gas, iron ore, copper, corn, and cotton.

Mining, extracting, planting, harvesting, processing, refining, and transporting these critical resources is a multi-trillion-dollar business that drives the economy.

When technology stocks are soaring, it’s easy to forget about commodities as an asset class. But when commodities enter an uptrend, it tends to create extraordinary wealth-building opportunities. We are in the early innings of one such uptrend.

For many professional investors, Brazil is a preferred way to play commodities in the stock market. Brazil is the world’s largest producer of soybeans, sugar, and coffee. It’s a major producer of cattle, cotton, corn, and orange juice. It’s a major producer of iron ore and crude oil.

Given all this, Brazil’s stock market tends to rise and fall with commodity prices. For me, it’s one of the ultimate “weathervanes” of the critical resource investing world.

As you can see from the 1-year chart of the iShares Brazil ETF (EWZ), Brazil is breaking out to new highs and is in a clear uptrend. The “trend tailwinds” are blowing in the critical resource world. It’s a time to be long.

Market Notes

- Warehouse robotics leader Symbotic (SYM) reached a new all-time high today. The robotics theme continues to generate wealth and winners.

- The cybersecurity megatrend continues producing winners: cybersecurity leader Zscaler (ZS) reached a new all-time high today.

- The new “humanoid” robotics investment fund – the RoundHill Humanoid Robotics ETF (HUMN) – reached a new high today.

Market Trend Leaderboard