Money & Megatrends

November 12, 2025

By Brian Hunt

In Preview Today:

As I expected, biotech stocks are booming. This is one of our best trades and recommendations of the year. We also look at the soaring market values of two American financial giants and ask the apocalyptic financial gurus: Can things be all that bad?

Plus, yet another reason to be long the robotics megatrend.

-Brian Hunt

Opportunity Is Everywhere in This Soaring Sector

This week, the market is sending us a clear message: It’s a bull market in biotechnology stocks, and opportunity is everywhere.

Regular readers are familiar with our bullish stance on biotechnology. On August 18, I sent a research note to colleagues detailing my bullish take on the biotech sector’s price action. Since then, I’ve written eight updates on the biotech bull market, as the sector has outpaced the S&P by a factor of four.

The biotechnology sector is full of companies working on cures and treatments for hundreds of diseases. When investors grow interested in this industry, the returns can be incredible. During the last biotech bull market, the sector soared 300% over four years.

Because biotech has performed poorly since 2021, most investors are indifferent to it. Butthis industry could start regularly generating stock market doubles and triples thanks to new technological advances.

The fusion of AI + biology will generate dozens of compelling stock narratives over the coming years. Researchers armed with AI programs will be able to run millions of digital simulations for every drug and treatment. Drug development will shift into overdrive, creating many big stock winners.

Companies that use AI to “crack the code” for various diseases and drugs will enjoy 100%… 500%… even 1,000%+ stock rallies.

The market likes this bull case for biotech. Since our note, the SPDR Biotech fund (XBI) – which holds small-cap biotechs – is up 26%. Shares broke out to a new 1-year high this week. The iShares Biotech Fund (IBB) – which holds large biotech stocks – is up 18%. Shares broke out to a new 1-year high this week. Biotech giant Amgen (AMGN) hit a new all-time high this week.

These moves confirm a biotech bull market … one full of opportunity.

Biotech Is a Market Leader

Five Very Bullish Signs for America

The bearish economic forecasters took another beating today.

Over the past year, I’ve frequently cited the soaring market values of big banks, select heavy equipment makers, and U.S. manufacturing stocks as evidence that the U.S. economy “can’t be all that bad.”

The bull markets in these critical sectors are making hash out of the ideas produced by the “doom-and-gloom” financial media industry – the one that has forecasted 49 out of the last two bear markets. Following the advice of these misguided gurus has proven to be very costly in terms of opportunities missed.

Today’s trading in Goldman Sachs (GS), Morgan Stanley (MS), Bank of America (BAC), American Express (AXP), and JP Morgan (JPM) furthered the “things can’t be all that bad” case for the U.S. economy.

Each of these key firms reached new all-time highs today.

These five firms, and others like them, are the financial backbone of America. They rise and fall with America’s ability to make money, save money, start companies, invest money, service loans, and generally “get along.” When these companies plummet to new 1-year lows, it’s a dark warning sign. When they surge to new all-time highs, it’s a bullish sign.

As you can see in this 1-year chart of Wall Street giant Goldman Sachs, we’re getting clear bullish signs from the market. Today, Goldman surged 2.7% to reach a new all-time high.

Goldman Sachs Soars to New Highs

The Robotics Megatrend Generates Yet Another Big Winner

This week, Ambarella (AMBA) notched a new 1-year high.

It’s yet another sign the robotics megatrend is one of our economy’s greatest opportunity zones.

Over the past 18 months, I’ve urged friends and colleagues to become heavily involved in the robotics megatrend. It is one of the biggest financial opportunities of our lives.

At Money & Megatrends, we occasionally trade and track trends that last less than 12 months, but the robotics megatrend will last more than 12 years.

It is a massive, multifaceted trend that will transform the world. It will yield greater factory automation, surgical robots, autonomous cars, autonomous air taxis, humanoid worker robots, and much more. Robotics investment is expected to rise at least 15% annually through the rest of this decade. Within five years, Amazon will utilize more robots than employees.

Because robots must sense what is in front of them to be safe and useful, one of this trend’s most promising “facets” is machine sensory perception. This field includes cameras, lasers, heat sensors, force sensors, and magnetic field sensors. Companies in machine sensory perception are enjoying a huge tailwind.

Ambarella is a $4 billion market cap semiconductor company that designs chips for machine vision. These chips have applications in drones, autonomous cars, and other machines that require vision. The stock is a favorite of our friend and tech investing wizard Luke Lango.

As you can see in the chart below, it’s a bull market in Ambarella. The company is riding the robotics megatrend to new 1-year highs. I remain long robotics.

Another Winner in the Robotics Megatrend

Market Notes

- Technology supergiant Alphabet (GOOG) reached a new all-time high today. It’s a sign of health for the broad technology sector.

- Factory automation via robotics firm Rockwell Automation (ROK) reached a new 1-year high today.

- Robotics/manufacturing boom play RBC Bearings (RBC) reached a new 1-year high today.

- The bull market in all forms of electricity production continues… the Global Wind Energy Fund (FAN) reached a new 1-year high today.

- AI-focused insurance firm Lemonade (LMND) reached a 1-year high today.

- The worldwide stock market boom continues. Today’s new 6-month highs include the Dow Industrials (DIA), iShares Japan (EWJ), iShares Mexico (EWW), iShares Italy (EWI), iShares Hong Kong (EWH), and iShares South Africa (EZA).

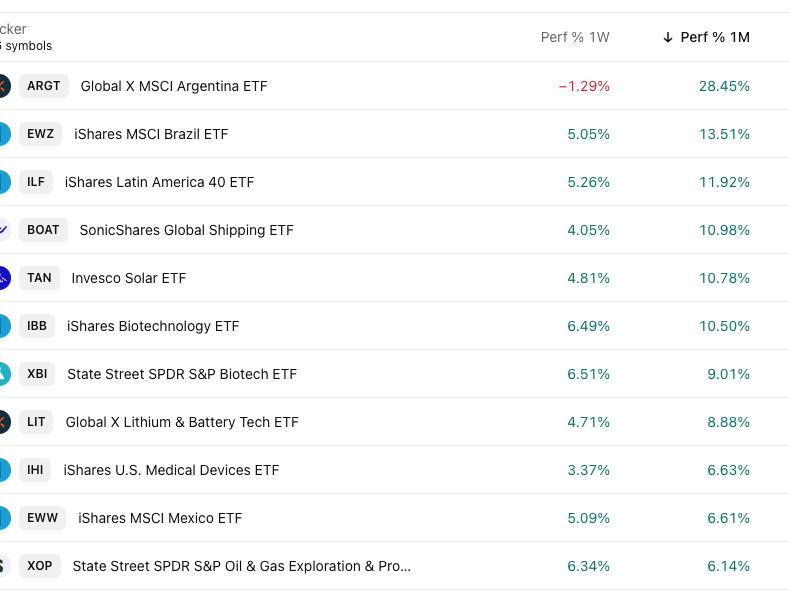

Trend Leaderboard

Top performing themes and trends over the past month