Money & Megatrends

November 17, 2025

By Brian Hunt

Inside today’s issue:

- The biotech sector powers to new highs, displaying phenomenal strength in a weak market

- Two of the world’s leading oil producers reach new highs, confirming the bull market in energy stocks

- The small-cap bulls will have to wait on that rally

- The Boomer health care trend generates another big winner

The Biotech Sector Powers to New Highs, Displaying Phenomenal Strength in a Weak Market

On October 28, the benchmark S&P 500 reached an all-time closing high of 6,890.89. At the time, investors were maximum bullish on AI, and they believed interest rate cuts were on the way that would juice the stock market further.

Since then, investor sentiment has turned dark. The financial press is full of stories about the AI bubble and how the bull market may be out of steam. The S&P 500 is down 1.94%. Tech stocks, as measured by the Nasdaq 100, are down 3%. Many leading growth stocks are down more than 10%.

This ugly broad market environment makes the recent new highs in biotech stocks one of the most impressive market events of 2025.

Today, the SPDR S&P Biotech ETF (XBI) surged to a 1-year high. The iShares Biotech Fund (IBB) – which holds large biotech stocks – reached a new 1-year high. Biotech giants Amgen (AMGN) and Gilead Sciences (GILD) hit new all-time highs today.

Biotechnology is considered one of the market’s high-risk, high-reward sectors. When investors flee such sectors, as they have over the past three weeks, biotech companies typically suffer. Biotech stocks rising to new highs in a market that is punishing high-reward, high-risk sectors is incredible. XBI is now up 17% since my August 18 research note about XBI’s bullish price action.

The bull case for biotech states that the fusion of AI + biology will generate dozens of big winners over the coming years. Researchers armed with AI programs will be able to run millions of digital simulations for every drug and treatment. Drug development will shift into overdrive, creating many big stock winners.

Companies that use AI to “crack the code” for various diseases and drugs will enjoy 100%… 500%… even 1,000% or more stock rallies.

As you can see from the 1-year chart of XBI, the market likes this narrative. Biotech is in a bull market. Trade accordingly!

Biotech stocks soar in a weak market

Two of the World’s Leading Oil Producers Reach New Highs, Confirming the Bull Market in Energy Stocks

Biotech isn’t the only sector that is strong in a weak market climate. Oil and gas stocks are reaching new highs as well.

For evidence, we point to the new 1-year highs in oil sector blue chips ExxonMobil (XOM) and Suncor (SU).

On September 29, I highlighted the emerging leadership of oil and gas stocks and stated it’s time to be long this sector.

The bull case for oil stocks is simple. If the global economy is growing, oil demand will remain solid. But importantly, U.S. shale oil production growth looks like it is peaking. This would remove a reliable source of production growth that has been in place for over a decade. Plus, oil is very cheap relative to gold and other assets, indicating good value.

However, regular readers know I care less about the reasons why a market may move up or down than I care about where that market is actually moving. You can believe a market will go up or down all you want, but if it’s not moving in your favor, then the idea is a loser. In other words, I place a lot more value on reacting to price action than I do on forecasting price action.

In the case of oil, the price action movement is up. ExxonMobil and Suncor are two of the top blue chip North American oil stocks. They are common choices for large institutional money managers that want to take a position in oil stocks.

Over the past week, both stocks have registered a series of new 1-year highs. Trends tend to persist, so I expect to see even more in the coming months.

In a weak market, ExxonMobil reaches a new high

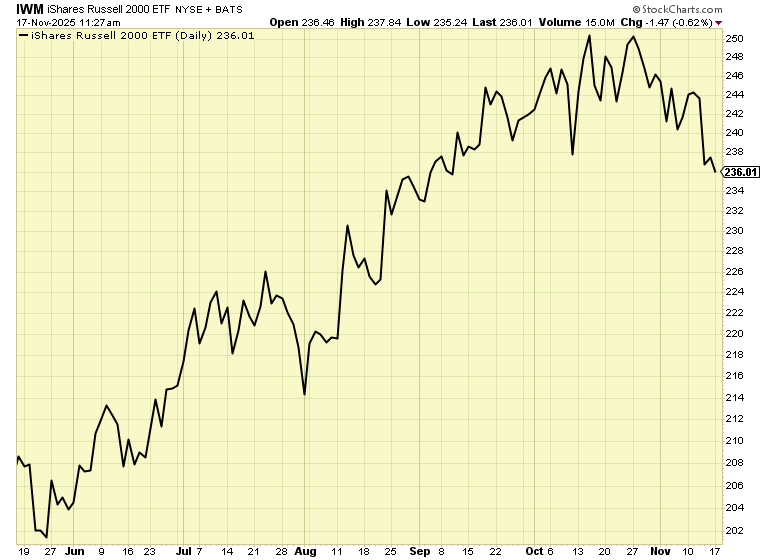

The Small-Cap Bulls Are Going to Have to Wait on That Rally

For those of us bullish on small caps, the rally will have to wait.

At least that’s what the market is saying today.

On October 15, I pointed to the bullish price action in small-cap stocks and said it was time to add a position there.

Small-cap bulls say these stocks have underperformed large caps because high interest rates and high inflation hit small companies harder than large companies. This underperformance has left small caps relatively cheap, trading at a forward P/E ratio of 15, compared to the S&P’s 23.

If Donald Trump gets his wish of lower interest rates, however, small caps could become much less cheap. Lower rates should benefit small-cap stocks more than large-cap stocks.

In my original note, I mentioned that the iShares Russell 2000 ETF (IWM) had reached a new 1-year high. Since then, however, IWM has sold off.

Today, the fund reached its lowest point in two months. For now, the small-cap rally is off. I await the return of the uptrend before saying it is safe to get back in.

Small caps reach a 2-month low

Market Notes

- A major sign of health in the gold stock bull market: Barrick Mining (B) – which is one of the world’s largest gold miners – reached a new all-time high today.

- Senior living home operator Ventas (VTR) reached a new all-time high today. This is more confirmation the Boomer health care trend is alive and well.

- Giant lithium miners SQM (SWM) and Albemarle (ALB) reached new 1-year highs today. Battery demand is driving this bull market.

- Bitcoin-focused Strategy (MSTR) reached a new 1-year low today. It’s down 42% over the past year.

- The Invesco Dynamic Pharmaceuticals ETF (PJP) reached a new 1-year high today. The bull market in Big Pharma continues.