Money & Megatrends

October 6, 2025

By Brian Hunt

Inside today’s issue:

- Bitcoin breaks out to new all-time highs

- Bitcoin’s “hard money” cousin gold climbs to another all-time high and highlights the opportunity in gold stocks

- A quick word on the broad market that is sure to offend some people

- Our “Space Trade” continues to reward investors

Bitcoin Powers to a New All-Time High and Confirms the Crypto Bull Market Is Alive and Well

This morning, leading cryptocurrency Bitcoin reached an all-time high of $125,500. This signals we are in a healthy bull market for cryptocurrencies that holds many opportunities.

The bull case for Bitcoin is like the one for gold. The governments of most wealthy Western nations have promised far too many things to far too many people. The related debts and obligations governments have taken on cannot be paid back with sound money. They can only be paid back with debased, devalued money… much of which is created out of thin air. This is driving inflation and significant currency debasement. Prices are going up because the value of our money is going down.

In this environment, people are flocking towards safe stores of wealth and debasement hedges like Bitcoin and gold.

In other words, there’s a powerful bullish force and narrative behind Bitcoin… and the trend is up. That’s all I need to know to be trading this market from the long side.

To profit from Bitcoin’s “trend tailwind,” you can make it simple and just own Bitcoin. Then there’s the world of publicly traded stocks that do well when Bitcoin does well… like crypto trading platform Coinbase (COIN) and the Blockchain ETF (BKCH), which holds a basket of crypto-related stocks.

Trends tend to persist and winners tend to keep on winning. Keep that in mind as you consider a position in Bitcoin and the crypto area.

Bitcoin powers to a new all-time high

Bitcoin’s “Hard Money” Cousin Gold Climbs to Another All-Time High and Confirms the Opportunity in Gold Stocks

If digital money isn’t your thing, keep in mind that Bitcoin’s “hard money cousin” gold also reached a new all-time high this morning. Gold is up an incredible 42% this year.

The reason for gold’s strength is the same as Bitcoin’s. The value of paper money is going down and safe stores of wealth are holding their values.

I’ve owned gold since 2003 when I bought in the $350 per ounce area. Since then, gold is up 1,045%. In 2022, I sent frequent notes that forecasted a new leg up in this long bull market. We are in the midst of that new leg up. Gold has doubled in value since 2022.

Despite this year’s big run in gold, the investment public is largely indifferent towards gold mining stocks. It is not involved in this trade. If you talk gold stocks with your average group of affluent people in the 40–60 year old age group, they will look at you like you are crazy.

This indifference means more gold stocks gains are likely ahead.

Now that gold is soaring, gold miner profit margins and cash flows are starting to look incredible. This should draw big investment dollars into a small market and drive market values higher. I’m still long.

Gold reaches a new all-time high

A Quick Word on the Broad Market. The Primary Trend Is Up… So Cool It With the Bearish Gibberish

I’ve been so busy trading and writing about the market’s strongest themes that I almost forgot to think about the broad market. So, let’s think about it…

Despite all the negative-sounding things the bears and journalists like to talk about (debt, the gov’t shutdown, valuations, tariffs, AI spending), the broad market powered to a new high today. This of course is bullish. The primary trend is up.

You can take all the time and money the bears spend talking about government debt, Trump, tariffs, AI spending, and inflation… add it all up…and it isn’t 1% as important as what the primary trend is doing.

The trend is the judge, jury, and executioner of every idea. There is no freedom from the trend. Only freedom through it. And the trend right now is up. The bearish side is the losing side.

Someday, this giant AI-fueled uptrend will sputter and stop. All good things must come to an end. Trees don’t grow to the sky.

But right now, the trend of the broad market says we should be long.

End of story.

If you’re bearish and have a response or something to argue about, don’t send me an email. Don’t waste your time. Don’t try to dazzle me with your intellect by telling me about unemployment or deficits or an AI bubble or the high CAPE ratio or how crazy Trump is. I probably know more about all that stuff than you do. Also, none of it matters right now.

What matters is the trend.

Until the stock market starts exhibiting the three bad behaviors I detailed two weeks ago, none of the bearish narratives matter. I’m long.

The primary trend is up… so can it with the bearish gibberish

Market Notes

- Over the past year, we’ve pounded the table and then some on the robotics theme. This is an “inevitable” trend I am betting big on. Today, two of the robotics ETFs we follow (ROBO, BOTZ) reached new all-time highs.

- The “Space Trade” we highlighted on September 22 is running higher. The Ark Space fund (ARKX) just reached a new all-time high. Stay long space.

- The recent strength in Bitcoin is helping to power blockchain-related stocks to new highs… the Blockchain group (BKCH) we follow just reached a new all-time high.

- The uranium sector just gave us another signal the critical resources bull market is alive and well. The uranium group (URA) just climbed 3.4% to reach a new all-time high.

- The big and broad global bull market we’ve highlighted many times this year continues. Canada, Japan, Taiwan, and South Korea just reached new highs.

- The biotech theme we’ve highlighted many times recently is alive and well… small cap biotech fund (XBI) just reached another 6-month high.

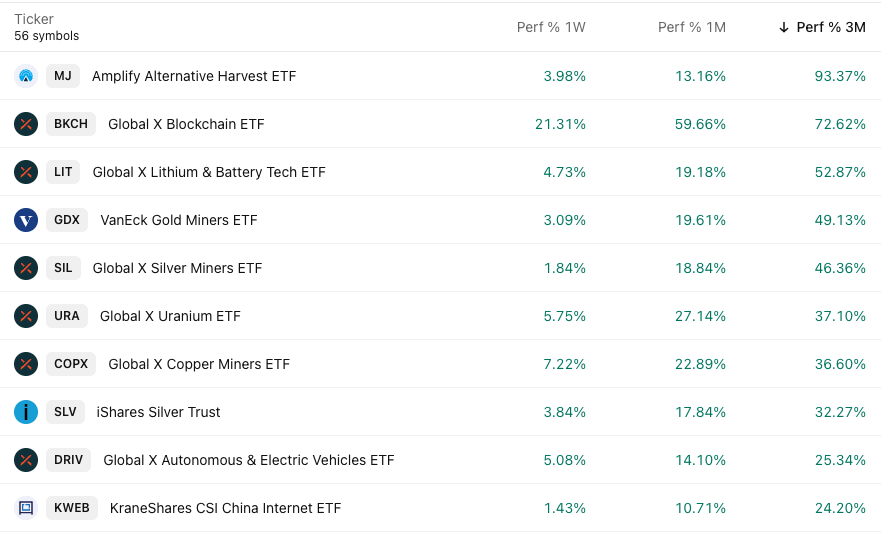

Market Trend Power Rankings

Top performing themes and trends over the past 3 months