Money & Megatrends

November 13, 2025

By Brian Hunt

Inside today’s issue:

- We pounded the table on it. Did you benefit? The Boomer health care trade is exploding higher.

- Keep a close eye on the copper miner theme and the Power Grid Upgrade theme. They are poised to break out to new highs.

- The natural gas trade, the oil trade, and the EPC trade continue to generate returns.

The Boomer Health Care Trade Explodes Higher: The Sector Is in a Bull Market — Are You on Board?

Since the start of November, the SPDR Health Care Fund (XLV) has surged 5.9% while staging a major 1-year upside breakout.

As you can see from the chart below, this breakout is impressive on its own. However, it’s even more impressive considering the broad market is flat during the same period.

This is further confirmation that the Boomer health care theme is one of the market’s great areas of opportunity.

Regular readers are familiar with the bull case: More than 10,000 Americans reach retirement age every day. That’s the giant Baby Boom generation entering the later stages of life… and a significant opportunity for the health care industry.

Ever since the Boomers hit the scene in 1946, they have been a demographic force to be reckoned with. They have powered a variety of big industry booms as they’ve progressed through life. For example, when Baby Boomers began buying starter homes in the 1980s, it drove big real estate bull markets in many cities.

Now, Boomers are in a phase of life where health care and longevity spending skyrocket. For many boomers, a typical month involves going to see at least one doctor to have something looked at, something removed, or something treated.

This means that many health care fields are experiencing huge demand now – and will for at least the next decade. It’s going to rain money on many health care businesses.

On October 1st, I highlighted XLV’s emerging price strength as a reason to be long this sector. Since then, XLV is up 10%, far outpacing the broad market’s gain of just 2.5%.

Given the long-term nature of the Boomer health care theme, we expect this theme to continue generating wealth over the coming years.

Health care stocks soar to new highs

A Critical Resource Market Approaches an Important Juncture: Put This One on Your Watch List

Over the past three months, I’ve repeatedly made the case that we are entering a bull market in many critical resource sectors.

As we covered in our September 22, 2025, edition, critical resources are the building blocks of the economy. Think raw materials like crude oil, natural gas, iron ore, copper, corn, and cotton.

Even today’s high-tech world of AI, apps, email, and Zoom calls is built on a “low-tech” foundation of steel, oil, concrete, copper, lumber, and aluminum. Mining, extracting, planting, harvesting, processing, refining, and transporting these vital resources is a multi-trillion-dollar business that affects every area of your life.

Many critical resource projects take 5 – 10 years to go from an idea on paper to producing raw materials. So, when a resource market trends in one direction, the trend tends to last for years.

Last year, we highlighted the bull case for copper and copper stocks:

Copper is widely used as a conductor to build power grids, data centers, power lines, and communication networks. When demand for power grids, renewable energy, and AI power usage booms, copper demand goes up. Plus, copper supply is constrained due to a lack of new discoveries.

Since our note, copper and copper stocks staged a large rally, one that was met with heavy selling in October. Since then, copper stocks – as represented by the Global X Copper Miner ETF (COPX) have moved in a sideways consolidation pattern.

But, as you can see in the chart below, this sector is preparing to make a run at its previous highs. A breakout here would be major confirmation of the critical resource bull market’s health. I bet it happens soon.

Copper stocks prepare to make a run at the previous high

The Power Grid Upgrade Theme Is Ready to Make a Run at Previous Highs — Will You Benefit From a Breakout?

Speaking of a run at previous highs, keep an eye on the Power Grid Upgrade theme and its representative ETF – the First Trust NASDAQ Clean Edge Smart Grid Infrastructure Index Fund (GRID).

Like the copper mining sector covered above, this theme – which we are very bullish on – is preparing to “launch an assault” on its previous highs and enter a new leg of its bull market.

On October 7, we introduced the Power Grid Upgrade theme as a way to invest in the AI boom.

Regular readers know power consumption is one of the most critical facets of the AI megatrend. Given AI’s enormous promise, the world’s largest and richest companies are embarking on the biggest capex spending cycle in history. Giants like Google, Meta, Microsoft, and OpenAI are spending hundreds of billions of dollars on data centers, AI chips, and other infrastructure components.

All that AI infrastructure is poised to consume huge amounts of electricity. Goldman Sachs forecasts global power demand from data centers will climb 50% by 2027 and by as much as 165% by the end of the decade.

This makes the looming upgrade of the global power grid a huge investment opportunity.

The U.S. power grid is often called the world’s largest machine. It’s an interconnected network of power stations, transmission lines, substations, and wires. Most people barely know it’s there or how it works, but without this big machine, your lights don’t turn on, there’s nothing to watch on Netflix, and your iPhone doesn’t charge.

Industry experts say the power grid is aging and creaking under the strain of increased electricity demand. The American Society of Civil Engineers (ASCE) gave the energy sector a D+ on its 2025 Infrastructure Report Card, citing concerns about growth in energy demand, an aging system, and a lack of transmission capacity.

Soaring electricity demand… a grid badly in need of an upgrade… AI supremacy on the line… trillion of dollars of economic output on the line…

We state again: This is a recipe for a bull market in companies that build, repair, and upgrade our power grid.

The market clearly likes this theme. The GRID fund is up 25% in the past six months. As you can see in the 1-year chart below, GRID – which has been trading in a sideways consolidation pattern over the past three weeks – is gearing up to make a run at its previous highs. We bet this happens soon.

Power grid upgrade stocks get ready to make a run at previous highs

Market Notes

- Invesco Dynamic Pharmaceuticals ETF (PJP) reached a new all-time high today. This is the Boomer health care theme at work.

- Communications network giant Cisco (CSCO) soared to a new all-time high today after reporting strong revenue related to AI spending. The AI Boom continues.

- Natural gas giant EQT (EQT) reached a new 1-year high today. This is confirmation that our natural gas trade is working.

- Gold mining giant Barrick (B) reached a new multi-year high today. This is confirmation that the gold stock uptrend is intact.

- Blue chip Canadian oil producer Suncor (SU) reached a new high today. The oil uptrend continues to reward investors.

- Leading construction firm AECOM (ACM) reached a new 1-year high today. This is more evidence the EPC theme is a winner.

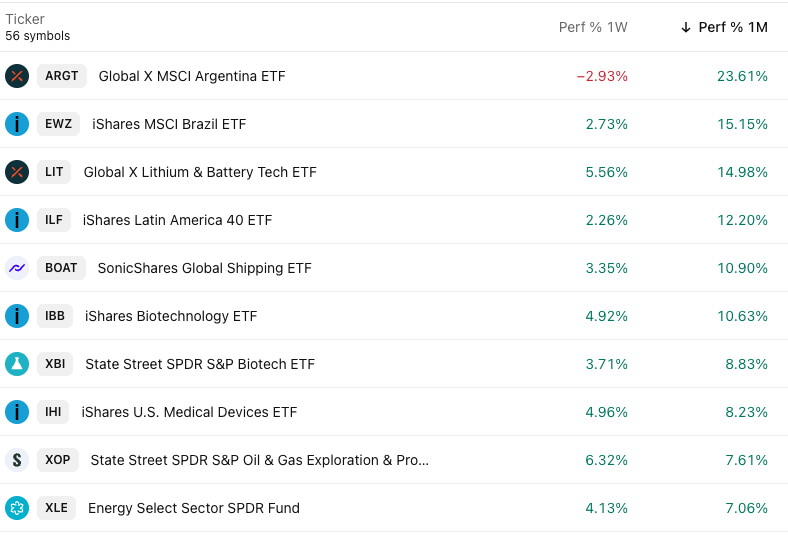

The Market Trend Leaderboard

Top performing themes and trends over the past 1 month