Money & Megatrends

October 23, 2025

By Brian Hunt

Inside today’s issue:

- Donald Trump hands a gift to oil and gas investors

- Here are the critical levels for the “small cap trade”

- A key robotics fund is knocking on the door of a new all-time high

- Key health care stocks confirm the sector’s bull market

This One Chart Shows It’s a Bull Market in U.S. Manufacturing

Oil and gas investors started their day with a gift from Donald Trump.

Late yesterday, the White House announced planned sanctions against major Russian oil and gas producers, boosting crude oil prices and sending many oil and gas stocks at least 2% higher during the morning session.

The SPDR Oil & Gas Equipment & Services ETF (XES), which we wrote bullishly on, is up 4% and reached a new six-month high. Oil giants ExxonMobil (XOM), Shell (SHEL), and Chevron (CVX) are moving higher and have strong uptrends working in their favor.

We all know Trump likes to bluster and threaten during negotiations and then back off later. Any market move Trump creates one day can easily reverse the next.

However, I believe this oil and gas stock rally is sustainable. Here is my bull case for oil:

If the global economy is growing, oil demand will remain solid. But importantly, U.S. shale oil production growth looks like it is peaking. This would remove a reliable source of production growth that has been in place for over a decade.

Plus, oil is very cheap relative to gold and other assets, and the investment public is indifferent toward oil and gas stocks. I could profitably trade stocks for the rest of my life just by owning assets in uptrends that the public is hostile or indifferent toward. It’s a “dynamic duo” for making money in stocks. I bet this nascent uptrend keeps running.

Oil and gas stocks surge to a new six-month high

Here Are the Critical Levels for the “Small Cap Trade”

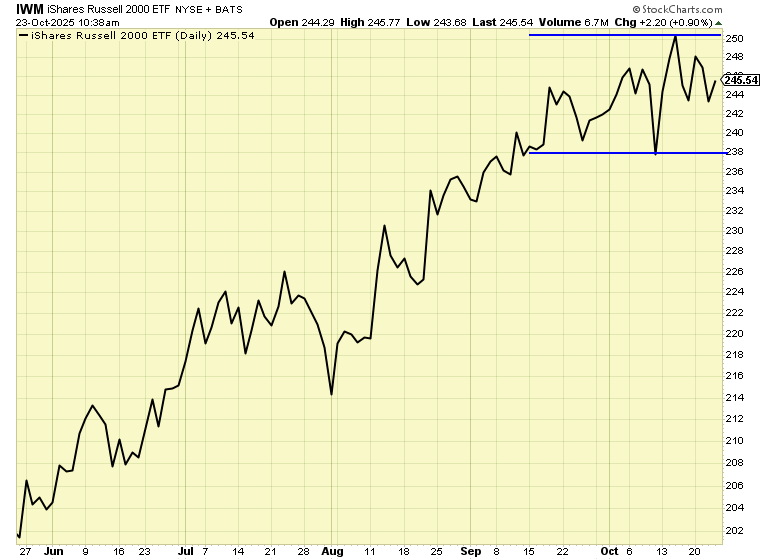

On October 15, we noted the upside breakout in the iShares Russell 2000 ETF (IWM) and said it was time to be long small-cap stocks.

Like many sectors, small caps have become something of a “Trump Trade.”

Small-cap bulls say these stocks have underperformed large caps because high interest rates and high inflation hit small companies harder than large ones. This underperformance has left small caps relatively cheap, trading at a forward P/E ratio of 15, compared to the S&P’s 23.

If Donald Trump gets his wish for lower interest rates, small caps could become much less cheap. Lower rates should benefit small caps more than large caps.

Regular readers know I believe it’s good to know the fundamentals, but they are much less important than what the market thinks of those fundamentals Fundamentals ride in the backseat. Price drives the car. You can be bullish on a theme until you’re blue in the face, but you have a losing idea if the market isn’t moving in your preferred direction.

After our October 15 note, the small-cap breakout reversed because of heavy selling pressure. This back-and-forth action has left the small-cap benchmark ETF in a sideways consolidation. As you can see in the chart below, IWM has been stuck in the 238 – 250 area since mid-September.

Keep an eye on the 250 area. Should IWM break it to the upside, you want to be on the long side.

Small caps and their consolidation zone

A Key Robotics Fund Is Knocking on the Door of a New All-Time High

“Every giant demographic trend, every giant technology trend, and every giant geopolitical trend leads to massively increased spending on robotics.”

That’s how you can sum up our table-pounding bullishness on robotics.

Over the past 18 months, I’ve urged friends and colleagues to become heavily involved in the robotics megatrend.

It is a giant, multi-faceted trend that will change the world. It will yield greater factory automation, surgical robots, autonomous cars, autonomous air taxis, humanoid worker robots, and much more.

It is one of the most significant financial opportunities of the 21st century.

Multiple world-shaping tectonic trends are working in robotics’ favor, making it an “inevitable” megatrend.

Robotics has a big demographics trend working in its favor. As Western countries age, robots are needed to backfill retiring workers.

Robotics has exponential technological progress working in its favor. Every year, robots get more advanced and much cheaper. This ensures their proliferation.

Robotics has Donald Trump’s push to greatly increase U.S. manufacturing capacity working in its favor. All the factories to be built will have lots of robots working in them.

The robotics megatrend has every major economic, technological, political, and demographic trend working in its favor.

Every. Single. One.

All trends listed above demand the extraordinary productivity that robotics can provide. You can stack all those megatrends to form an inverted pyramid. Every pound of their immense financial weight is pushing down onto a point. That point is massively increased robotics spending over the coming decade.

But don’t just take my word for it. Much more important than what I think is what the market thinks. The ROBO Global Robotics & Automation ETF (ROBO) is close to reaching a new all-time high. The market likes the “long robotics” thesis.

It’s a bull market in robotics

Market Notes

- Today, the market provided more confirmation that the health care theme is a winner.

Leading hospital operator HCA Healthcare (HCA) reached a new six-month high…

health care data and testing giant IQVIA (IQV) reached a new six-month high…

and diversified health care giant Thermo Fisher Scientific (TMO) reached a new six-month high. - Today, the big Brazilian iron ore miner Vale (VALE) reached a 12-month high.

This confirms that the critical resources sector is in a long-term bull market.

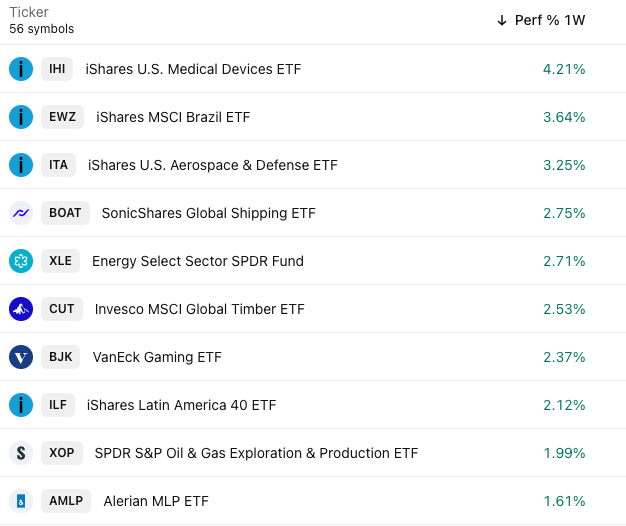

Market Trend Power Rankings

Top performing themes and trends over the past 1 week