Money & Megatrends

November 11, 2025

By Brian Hunt

The More Data Centers They Build, the More These Stocks Go Up

Hello everyone.

Today, we check in on the booming EPC trend. The more data centers they build, the higher these stocks go. We also look at the strong uptrend in oil and gas stocks. And finally, we take a tour of the worldwide stock market boom. Make sure you’re on the right side of it.

On October 24, 2024, I sent a research note to colleagues about my enthusiasm for companies building AI data centers and the infrastructure required to operate them.

I summed up the bull case like this:

The Mag 7 tech companies are racing to dominate AI products and services. These are the richest companies in all recorded history. They have more cash on hand than any group of companies has ever had. If a big tech company blows AI, it could end up as roadkill. If a big tech company plays AI well, it will add trillions more in market cap, and its executives will become very, very rich. These guys are going to overspend on AI, not underspend.

When it comes to building data centers, Mag 7’s view on construction costs and time frames can be summed up as, “I don’t give a s**t what they cost… Build them yesterday.”

For the right equipment, component, construction, and engineering firms, it’s charge whatever you like at this point.

Since my note, at least five infrastructure builder stocks have gained more than 100%. And this week, leading construction firm Argan (AGX) gave us another reason to be bullish on this trend, which we call the “EPC boom.”

EPC stands for Engineering, Procurement, and Construction. These firms design and build giant infrastructure projects such as airports, skyscrapers, power plants, subways, and data centers.

President Donald Trump’s push to increase U.S. manufacturing capacity is benefiting these firms greatly. Some of the world’s largest manufacturers are poised to invest over $200 billion in new U.S.-based factories. Plus, EPC firms have the AI data center building trend working in their favor.

Argan is a $4.6 billion market cap builder of power plants and electrical infrastructure. Thanks to the data center building boom, the company has business booked farther than the eye can see. Shares are up 118% over the past year and recently hit a new all-time high. The EPC boom continues.

EPC firm Argan soars to a new high

The Big Oil and Gas Stock Uptrend Continues… Did You Get on Board?

In yesterday’s issue, I noted the outperformanceof the Baby Boomer-powered pharmaceutical stock group. Although the broad market has been weak recently, pharmaceutical stocks have stayed strong. This is a bullish signal for the sector.

Another theme that held up very well during the recent broad market weakness is oil and gas, which we’ve been bullish on for over a month.

Over the past 10 trading sessions, the S&P is down 0.62%. Yet, the oil-and-gas-focused Energy Select SPDR Fund (XLE) is up 2.34%. This is impressive “relative strength.”

The bull case for oil stocks is simple. If the global economy continues to grow, oil demand is expected to remain solid. But importantly, U.S. shale oil production growth looks like it is peaking. This would remove a reliable source of production growth that has been in place for over a decade. Plus, oil is very cheap relative to gold and other assets, indicating good value in oil.

The 3.5-year chart below of XLE shows the market likes this bull case.

The XLE – which has large weightings in oil giants ExxonMobil (XOM) and Chevron (CVX) – is in a clear uptrend and is a chip shot away from a new 1-year high. Given the investment public’s indifference towards oil and gas stocks, I bet this trend keeps running.

It’s a bull market in oil and gas stocks

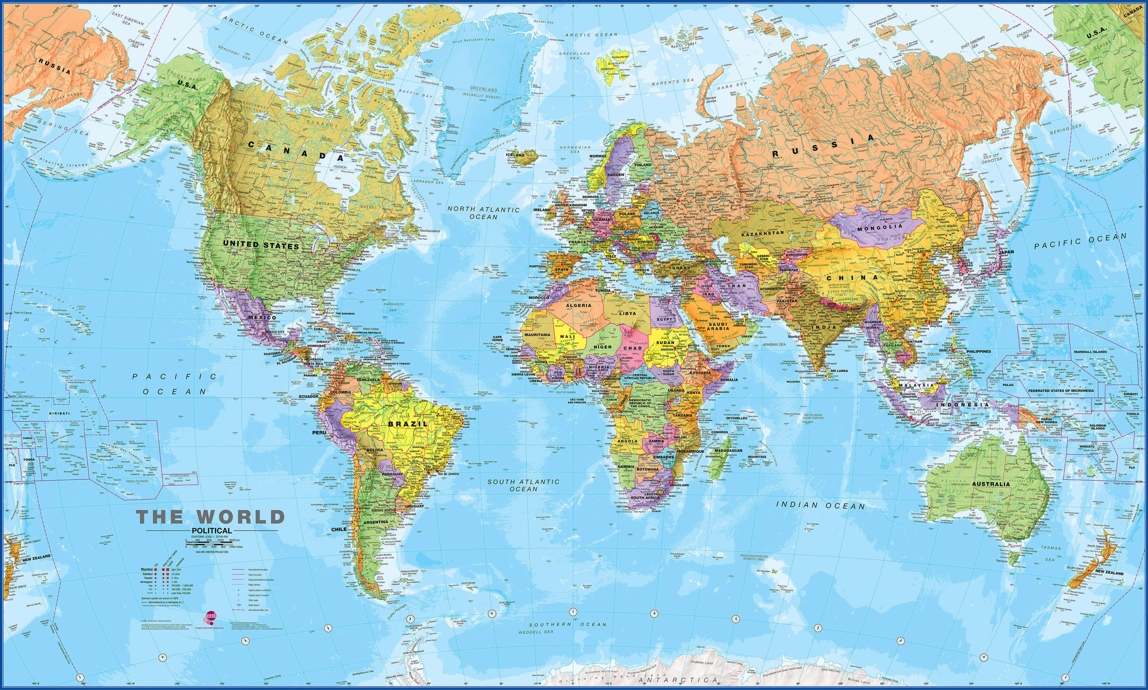

The Worldwide Stock Market Boom Hits High Gear… Are You Long?

Over the past year, I’ve frequently cited the wide variety of global stock uptrends as a reason to be bullish, rather than bearish, on stocks.

The worldwide proliferation of uptrends means apocalyptic market forecasters are swimming against, rather than with, very powerful economic currents.

Today’s market action delivered this reality yet again.

On the new 6-month highs list, we see:

- Many big European banks, such as Barclays (BCS), HSBC (HSBC), and Deutsche Bank (DB).

- Canadian banking giants Bank of Nova Scotia (BNS) and Canadian Imperial (CM).

- South America’s largest fintech company, Nu Holdings (NU).

- Europe’s largest telecom company, Vodafone (VOD).

-

Country-specific ETFs focused on Hong Kong (EWH), Brazil (EWZ), Malaysia (EWM),

Mexico (EWW), Spain (EWP), UK (EWU), Colombia (COLO),

Italy (EWI), and Latin America (ILF). - Diversified global oil giants BP (BP), Shell (SHEL), and ExxonMobil (XOM).

Said another way, we are still in the confines of a broad global stock market boom.

Since the markets are up so much over the past few years, there’s no shortage of bears who say we’ve climbed too far… that a market apocalypse is ahead.

The bears may sound clever, but they are also wrong… as judged by the only judge that matters: the trend. The trend worldwide is one of higher stock prices. Make sure you’re on the right side of it.

Market Notes

-

Large cap drug makers Eli Lilly (LLY), GSK (GSK), and AstraZeneca (AZK)

hit new 1-year highs today. It’s another sign the Boomer health care megatrend is alive and well. - Robotics and U.S. manufacturing play RBC Bearings (RBC) reached a 1-year high today.

-

St. Joe (JOE) is a large real estate development company focused on Florida.

Shares hit a new 1-year high today.