Money & Megatrends

October 30, 2025

By Brian Hunt

Inside today’s issue:

- One of the world’s most explosive sectors powers to new highs

- A major development for the critical resources uptrend

- Oil service stocks are up big since our call… did you act and profit?

- Industrial stocks power to new highs. We again ask the “doom and gloom” gurus, Can the economy be all that bad?

Holy Biotech! One of the World’s Most Explosive Sectors Powers to New Highs

The past week’s trading is further confirmation that our Biotech Revival theme is one of the world’s most rewarding uptrends.

Today, the biotech fund we track – the S&P Biotech ETF (XBI) – climbed 1.2% to reach a new 52-week high, gaining an impressive 16% since we introduced it on September 19 (a 142% annualized pace).

The biotechnology sector comprises companies working on cures and treatments for diseases. When investors grow interested in this industry, the returns can be incredible. During the last biotech bull market, the sector soared 300% over four years.

However, the biotech sector has been a river of no returns since late 2021. Rising interest rates and investor disinterest have kept stock prices low.

On September 19, we highlighted XBI’s budding uptrend and noted that the 2025 biotechnology theme contained an “AI kicker.”

The fusion of AI + biology will generate dozens of compelling stock narratives over the coming years. Researchers running intelligent AI programs will be able to run millions of digital simulations for every drug and treatment. These models will study how drugs affect different individuals, potentially leading to more personalized treatments. This will put drug development into overdrive… and create many big stock winners.

Companies that use AI to “crack the code” for disease and drug treatments will enjoy 100%… 500%… even 1,000%+ stock rallies.

The 1-year chart below shows the “trend tailwinds” are blowing at biotech’s back… making it one of the market’s most rewarding trends.

Biotech stocks soar to new highs

A Major Development for the Critical Resources Uptrend

Over the past two months, I’ve made the case that we are in a favorable environment for critical resources… one in which many individual resource sectors will generate strong returns.

Critical resources are the building blocks of the economy. Think raw materials like crude oil, natural gas, iron ore, copper, corn, and cotton.

Even today’s high-tech world of AI, apps, email, and Zoom calls is built on a “low-tech” foundation of steel, concrete, copper, lumber, and aluminum. Every day, our cars, trucks, and airplanes consume millions of barrels of fuel. Our lights turn on because we burn coal and natural gas.

Feeding, clothing, and housing billions of people consumes enormous amounts of agricultural products, like corn, wheat, soybeans, rice, cotton, sugar, coffee, lumber, and livestock.

Mining, extracting, planting, harvesting, processing, refining, and transporting these vital resources is a multi-trillion-dollar business that affects every area of your life.

When technology stocks are soaring, it’s easy to forget about commodities as an asset class. But when commodities enter an uptrend, it tends to create extraordinary wealth-building opportunities. We are in the early innings of one such uptrend.

With all this in mind, note the 1-year highs in BHP Billiton (BHP), Rio Tinto (RIO), Southern Copper (SCCO), and Vale (VALE) reached this week.

These are four of the world’s largest mining companies. They mine a large portion of the world’s iron ore, copper, and coal. Given their size, scope, and trading liquidity, BHP, Rio, Southern Copper, and Vale are “go-to” choices for large money managers when they want to take positions in critical resources.

ETF-focused investors will want to know that the strength in the four companies above is driving the iShares MSCI Global Metals & Mining Producers ETF (PICK) to new 1-year highs. This is a fund that owns many large, diversified miners.

Right now, gold and silver are in bull markets. Uranium and uranium stocks are in a bull market. Copper is in a bull market. Rare earth miners are in a bull market. Coal stocks are in a bull market. And now four of the world’s largest mining companies are at bull market highs. Yes, the trend is up for critical resources.

Mega miner BHP Billiton reaches a new high

Oil Service Stocks Are Up Big Since Our Call… Did You Act and Profit?

On the topic of critical resources, let’s talk about the biggest critical resource market of them all: Crude oil. Our trade in this sector is off to a great start.

On September 29, I highlighted the emerging leadership of oil and gas stocks and stated it’s time to be long this sector.

The bull case for oil stocks is simple. If the global economy is growing, oil demand will remain solid. But importantly, U.S. shale oil production growth looks like it is peaking. This would remove a reliable source of production growth that has been in place for over a decade. Plus, oil is very cheap relative to gold and other assets, indicating good value.

Our original note said the upside breakout in oil stocks was a bullish new development. That breakout was met with selling, which sent the sector back into its sideways consolidation area.

As the chart below shows, oil stocks regained their footing and have achieved “bull market” status.

Today, the SPDR Oil & Gas Equipment Services ETF (XES) hit a new 6-month high and is up 9.9% over the past month (an annualized rate of 118.8%). This fund owns a diversified basket of oil and gas drilling equipment and service companies, including land-based drilling rigs, offshore oil drilling platforms, drilling ships, pumps, pipes, and valves.

XES’s recent price strength is particularly notable as it’s happening during a period of crude oil price weakness. This past month, crude has traded down to multi-month lows. Oil service stocks, however, are blasting higher. This tells us that despite the short-term weakness in oil, the market believes large oil companies will keep spending on exploration.

Another factor working in the oil sector’s favor is investor sentiment. Sentiment towards oil and oil stocks can be charitably described as “indifferent,” which is bullish. I’m long.

Oil service stocks blast to a new multi-month high

Market Notes

- Industrials Select SPDR Fund (XLI) reached a new high.

This is the largest ETF devoted to U.S. industrial companies, such as Caterpillar (CAT), GE Aerospace (GE), Boeing (BA), Eaton (ETN), Honeywell (HON), and John Deere (DE). These companies form America’s industrial backbone.

Seeing this new high for industrials, we ask all the “doom and gloom” bearish gurus… Can things be all that bad in the economy?

We think no!

- Leading AI semiconductor industry players Applied Materials (AMAT) and ASML (ASML) reached new all-time highs today. The AI boom rolls on.

- Industrial robotics leader Rockwell Automation (ROK) reached a new 1-year high today. The robotics uptrend is alive and well.

Regards, and Remember: trends tend to persist

Brian Hunt

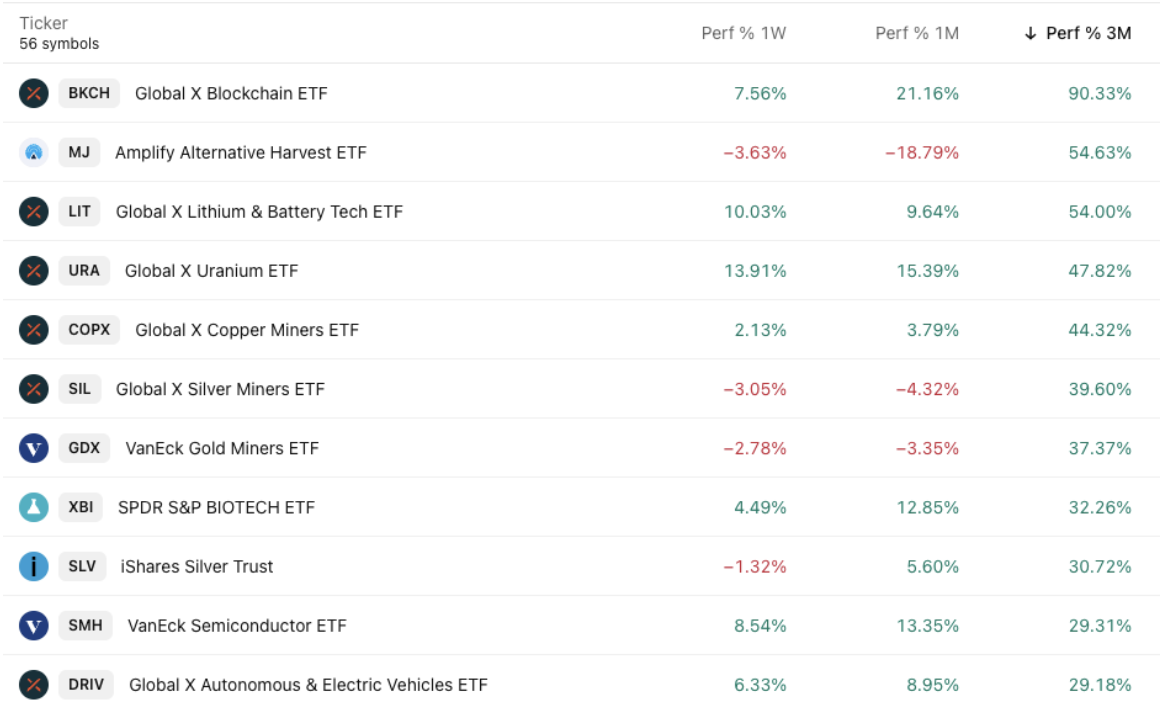

Market Trend Power Rankings

Top performing themes and trends over the past 3 months