Money & Megatrends

November 4, 2025

By Brian Hunt

Inside today’s issue:

- One of the strongest uptrends you probably don’t own

- The “Amazon of South America” is nearing a new all-time high

- Two of America’s most important companies reach new highs… can things be all that bad?

- The Boomer health care megatrend sends drug stocks higher

One of the Market’s Strongest Uptrends You Probably Don’t Own

Over the past five trading sessions, the benchmark S&P 500 stock index has declined 1.14%. The more volatile small-cap index – the Russell 2000 – is down 2% over the same period. Some high-profile growth stocks – Meta, Coinbase, Oracle, and Chipotle – are down more than 5% over the same time.

During times of broad market weakness, I seek out the stocks, ETFs, and themes that are holding steady or advancing. It’s a “stress test.”

If the market drops 3%, you want to see what drops just 1%. If the market drops 2%, you want to see what climbs 1%. That sort of thing. This is often called “relative strength.” It allows you to spot the safer megatrends for investment.

It’s like looking at a beachfront neighborhood after a hurricane. Some homes lost their roofs, and some homes have been blown away. But there are some homes unbothered by the storm. Those are the strongest homes.

The current “stress test” is telling us that Latin America is one of the market’s strongest uptrends. The iShares Latin America 40 ETF (ILM)– which is essentially the “S&P 500 of South America” – has not only refused to decline over the past five trading sessions, it has advanced 0.46%. It’s up 17% over the past three months.

Bulls on the region point out how “left-wing, full-blown socialist” Latin American political parties look increasingly to be replaced by “less left-wing, not full-blown socialist” political parties. This should be good for the continent’s stock markets. It certainly has been for Argentina, which recently moved toward “less socialism” and has seen its stock market soar 378% over the past two years.

Latin American stock markets are also reliant on critical resource markets such as iron ore, agriculture, copper, and oil. The critical-resources boom we’ve been covering is good for “LatAm” stocks.

The chart below shows the market likes the bull case for LatAm. ILF is trending higher and recently reached a one-year high.

A High-Growth Bet on South America Nears New Highs

Latin America’s recent performance makes now a good time to talk about a reliable strategy for finding great stocks… the exporting of great U.S. business models.

This strategy is simple: Look at a list of America’s outstanding stock market winners… and then buy the foreign versions of those businesses, which are often much younger than their American counterparts.

Despite its problems, the U.S. has the world’s most dynamic free enterprise system. It’s the system that has given life to Apple, Google, Nvidia, Tesla, Costco, Netflix, and Home Depot. It’s the system that leads all others in the creation of new technologies and business models. What gets created in America is often imitated elsewhere. This can be great for you as an investor.

Over the past 20 years, we’ve seen many instances of American business innovations successfully applied in foreign economies. A notable example is MercadoLibre (MELI) – also known as “the Amazon of Latin America.”

MercadoLibre is the largest e-commerce company in South America. It also operates a digital payments platform. It’s one of the world’s fastest-growing large companies.

As you can see from the 12-year chart below, MELI stock has enjoyed a strong uptrend for years. The stock is near all-time highs. If the LatAm trend keeps going, MELI stands to be one of its biggest winners.

The Amazon of South America nears all-time highs

Two of America’s largest banks power to new highs… can things be all that bad?

Stock market bears and recession forecasters take note: You were wrong last year. You were wrong in January. You’re wrong now.

This is the message of the market. It’s coming from today’s new all-time highs reached by Bank of America (BAC) and Wells Fargo (WFC).

Bank of America and Wells Fargo are two of America’s largest banks. These companies prosper when Americans are making money, depositing money, spending money, repaying loans, and servicing loans for homes and businesses.

Since the current bull market began in 2023, there’s been a whole doom-and-gloom industry built on bearish stock forecasts and recession forecasts. Anyone who listened to the doomers and avoided stocks has missed a historic wave of wealth creation. The “prophets of apocalypse” may sound clever and are often well-meaning, but they consistently prove to be wrong.

Stocks and business cycles move up and down in big cycles… so of course, we will see bear markets and recessions in the future. But as for right now, we look at the new all-time highs in Bank of America and Wells Fargo and ask the bears, “Can things be all that bad?”

Megabank Wells Fargo reaches a new high

Market Notes

- Genomic testing leader Natera (NTRA) reached a new high today… confirming the bull market in genomics is in full swing.

- EPC leader Sterling Infrastructure (STRL) reached a new high today… the U.S. infrastructure boom continues.

- The Invesco Pharmaceuticals ETF (PJP) reached a new high today. This fund is being driven higher by the Boomer health care megatrend.

- Maryland-based spice company McCormick (MKC) reached a new low today.

- Leading timberland operators Rayonier (RYN) and Weyerhaeuser (WYN) reached new lows today.

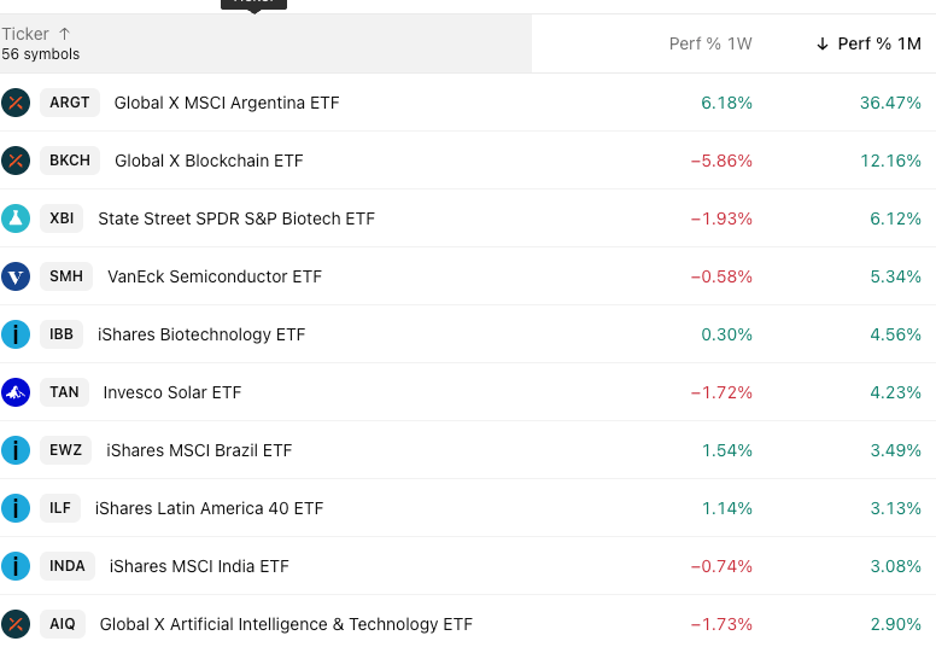

Market Trend Leaderboard