Money & Megatrends

October 7, 2025

By Brian Hunt

Inside today’s issue:

- The world’s largest machine needs a major upgrade. It’s a major investment opportunity.

- Did you take our advice and buy Quantum Computing? 141% gains in less than a month.

- Our new “RFK Jr. trade” is off to a great start.

- The drone megatrend continues to post new highs.

The World’s Largest Machine Needs a Major Upgrade — It’s a Major Investment Opportunity

In late 2022 – before ChatGPT was released to the public – I began telling friends and colleagues that AI was about to explode into public awareness. Shortly after, AI did just that and one of the biggest investment themes of our lives was born.

Since then, I’ve been one of the investment world’s most vocal and relentless bulls on “all things AI.” And of course, I’ve put my money where my mouth is (Winning).

Regular readers know one of the largest and most profitable facets of the AI megatrend is power consumption. Given AI’s enormous promise, the world’s largest and richest companies are embarking on the biggest capex spending cycle in history. Giants like Google, Meta, Microsoft, and OpenAI are spending hundreds of billions of dollars on data centers, AI chips, and other infrastructure components.

All that AI infrastructure is poised to consume huge amounts of electricity. We quote the International Energy Agency:

“…electricity demand from data centres worldwide is set to more than double by 2030 to around 945 terawatt-hours (TWh), slightly more than the entire electricity consumption of Japan today. AI will be the most significant driver of this increase, with electricity demand from AI-optimised data centres projected to more than quadruple by 2030.”

In past issues, we’ve highlighted “power plays” like utilities, solar, and natural gas as ways to benefit from this trend. Today, we highlight how all the nuclear power, solar power, and fossil fuel power in the world isn’t worth much if you can’t get it to customers.

This makes another “power play” – the looming upgrade of the global power grid – a big investment opportunity.

The U.S. power grid is often called the world’s largest machine. It’s an interconnected network of power stations, transmission lines, substations, and wires. Most people barely know it’s there or how it works, but without this big machine, your lights don’t turn on, there’s literally nothing to watch on Netflix, and your iPhone doesn’t charge.

Industry experts have warned us the power grid is aging and creaking under the strain of increased electricity demand. The American Society of Civil Engineers (ASCE) recently said the U.S. power grid is dangerous due to growth in energy demand, an aging system, and lack of transmission capacity. The ASCE gave the energy sector a D+ on its 2025 Infrastructure Report Card.

Rising demand… a grid badly in need of an upgrade… AI supremacy on the line… trillions of dollars of economic output on the line…

It’s a recipe for a bull market in companies that work to build and upgrade our power grid.

This is a big, broad theme with individual leaders like Quanta (PWR), Monolithic Power Systems (MPWR), and Eaton (ETN) at your disposal.

When it comes to ETFs, the selection is limited. There’s the “First Trust NASDAQ Clean Edge Smart Grid Infrastructure Index Fund” (GRID). This fund has an unfortunate name but it’s interesting. It holds a basket of leading power production and distribution companies.

As you can see, the market likes the “Power Grid Upgrade” theme. GRID is up 22% over the past year and is close to a new high.

Put this one in the category of “big, multi-year megatrend.” Long.

Powerful returns… and more likely on the way.

Quantum Computing Stocks Explode Higher and Confirm a New Stock Market Phenomenon

“Right now, you can make big money in stocks faster than at any time in history.”

This is one of my “mantras” that I’ve repeated so many times around the office that colleagues are getting sick of it. But I believe any important idea should be repeated over and over. The more often you hear about an idea, the more likely you are to retain it.

Right now, you can make big money in stocks faster than at any time in history thanks to the fusion of three modern-day phenomena. There’s blazing exponential progress in technology. There’s how business and stock market information now gets disseminated at light speed. And there’s the fact that thanks to high-frequency trading and smartphone-enabled trading, people can execute rapid trades – often in herds – from anywhere.

Add those up and you get a market that moves much faster than it did 20 years ago. Put another way, “This is not your father’s stock market.”

We are reminded of this today by the recent returns generated by quantum computing stocks.

Four years ago, my colleague and brilliant technology analyst Luke Lango told me that quantum computing was poised to be a big thing. I’ve followed and traded the group ever since.

Today’s traditional computers are built on top of the laws of classical mechanics. They use what are called bits, which store data binarily as either “1” or “0.” But quantum computers are based on quantum mechanics and use qubits, short for quantum bits, which can represent multiple states simultaneously.

This means they can process complex problems exponentially faster than classical machines. They could eventually cure diseases, drive the cost of energy down, and power artificial general intelligence.

On September 15, I highlighted the upside breakout in quantum computing stocks and urged readers to be long the group. Since then, quantum computing group leader Rigetti Computing (RGTI) has soared 141% (an annualized rate of 2,339%). Fellow leader D-Wave (QBTS) is up 109%.

Returns of 141% and 109% in less than a month? Yes, right now you can make big money in stocks faster than at any time in history.

Quantum Computing Stocks Soar to New Highs

Our “RFK Jr. Trade” Is Off to a Great Start

“Given how good this administration is at telegraphing what it is about to do and then doing it, this looks like a trade worth taking. This group could easily double with government support.”

That’s how we ended our initial note (Sept. 29) on the potential opportunity in psychedelic stocks.

I can’t remember a presidential administration that helps me make money like Trump & Friends does. Whether you like or dislike them, there’s no denying these guys make stocks move. They are creating great stock market opportunities.

Trump took over in January. Since then, their moves have sent rare earth mining stocks soaring. They’ve sent shares of Intel up 48% in two months. The tariff-related stock crash in April produced dozens of great setups on the long side. Trump’s support for crypto has helped generate a lot of gains in that sector.

On September 29, I highlighted psychedelics-related stocks as the next Trump-related opportunity.

Over the past decade, psychedelics-based treatments have gained a lot of support in the mental health world… and some slowly changing support from the government and universities.

Supporters say psychedelics are a big help in treating addiction and trauma. One such supporter is RFK Jr., who is rumored to be preparing more government backing for psychedelics.

This trade is off to a good start. The psychedelics fund (PSIL) we follow is up 5.1% since our note. This week, the fund reached a new 12-month high. I remain long.

Market Notes

- Back in December, we urged readers and colleagues to get long the autonomous military and surveillance drone megatrend. Since then, this theme has generated incredible gains. Leading drone makers AeroVironment (AVAV) and Kratos (KTOS) just hit new all-time highs.

- The uranium sector just gave us another signal that the critical resources bull market is alive and well. The uranium group (URA) just broke out to a new all-time high.

- The cannabis trade I highlighted on August 5 is up 73% in less than three months. The cannabis sector (MJ) is rallying hard on the belief that the Trump administration will relax regulations on the industry.

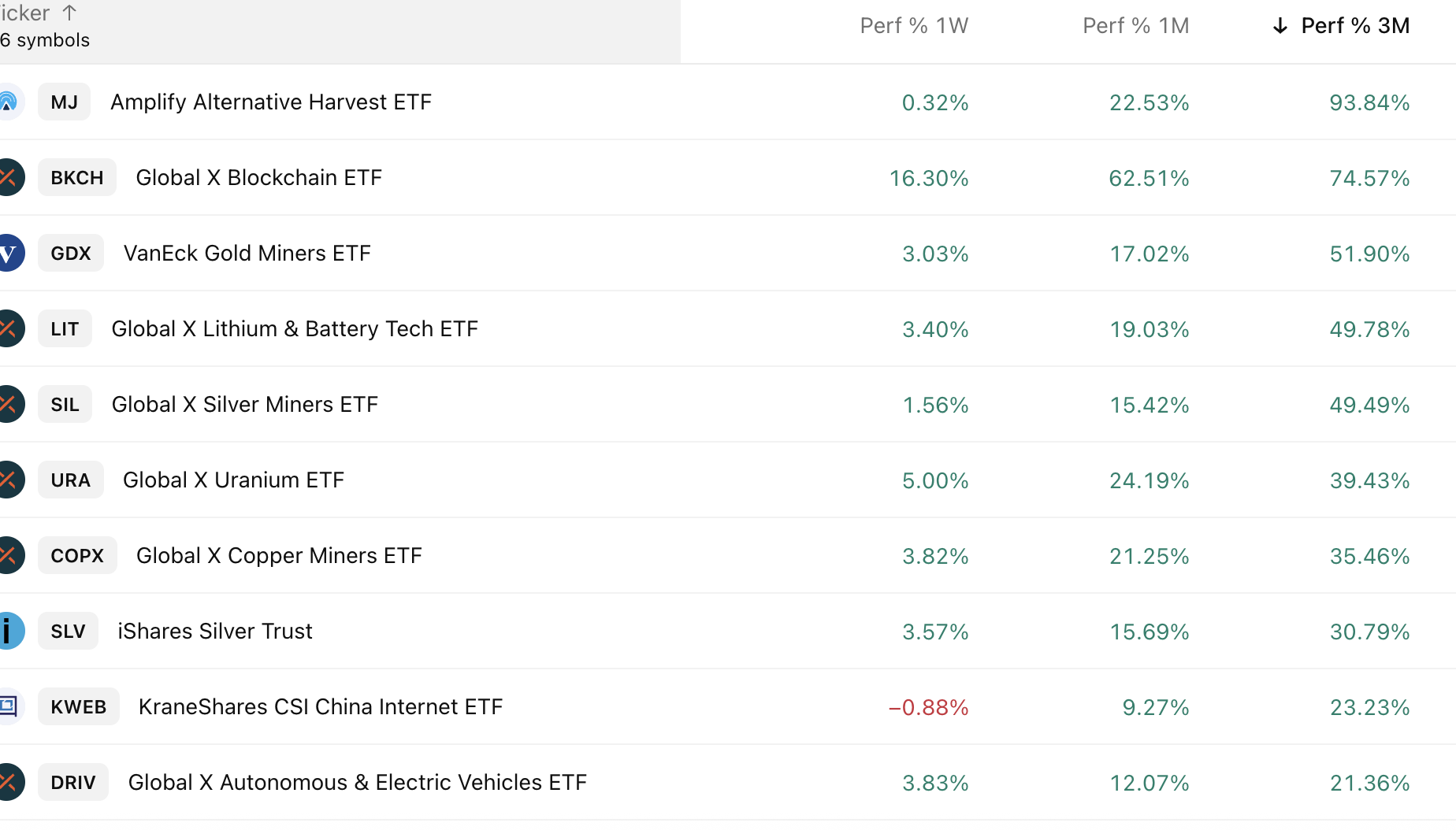

Market Trend Power Rankings

Top performing themes and trends over the past 3 months