Money & Megatrends

October 24, 2025

By Brian Hunt

Inside today’s issue:

- A major new development in the “AI Boom or AI Bust” debate

- Rising global defense spending is powering a huge bull market in the aerospace & defense industry

- Are you making money in tech? The Mag 7 powers to a new all-time high

- he oil and gas trade reaches a new high… the Boomer health care reaches a new high… Robotics reaches a new high… the EPC uptrend continues

Rising Global Defense Spending Is Powering a Massive Bull Market in the Aerospace and Defense Industry

In the October 1, 2025, issue, I highlighted the U.S. government’s efforts to greatly increase domestic missile production and its effects on the market.

As the Wall Street Journal puts it:

“The Pentagon, alarmed at the low weapons stockpiles the U.S. would have on hand for a potential future conflict with China, is urging its missile suppliers to double or even quadruple production rates on a breakneck schedule.”

Increased missile production is just part of the trend to grow defense spending, which is raising stock prices for aerospace and defense companies.

According to the Stockholm International Peace Research Institute (SIPRI), global military expenditures reached $2.7 trillion in 2024 — a 9.4% increase over 2023, the highest year-on-year rise in decades.

This huge spending increase is partly driven by Donald Trump’s insistence that European countries spend more of their own money on defense. The increased spending is driving windfalls across the aerospace & defense industry. On Tuesday, defense giant RTX (RTX) — formerly Raytheon — reported a quarterly revenue increase of 12% over the same period last year. Shares jumped to an all-time high.

Given this strong fundamental tailwind, it’s no wonder the biggest aerospace and defense ETF — the iShares U.S. Aerospace & Defense ETF (ITA) is in a long-term uptrend and close to reaching a new all-time high. The European-flavored aerospace and defense fund — the Select STOXX Europe Aerospace & Defense ETF (EUAD) — is also trending higher.

Highly rated aerospace & defense stocks on our Power Factor system include Optex Systems (OPXS), Astronics (ATRO), and AeroVironment (AVAV).

I’d rather see these stocks in a bear market. But I don’t make the rules; I look for strong trends. As you can see in the chart below, we have one in defense:

Aerospace & Defense stocks reach new highs

A Major New Development in the “AI Boom or AI Bust” Debate

As Friday’s trading closes, we mark another loss for the AI bears.

Over the past month, we have frequently highlighted how “AI Boom or AI Bust” has become the world’s most important financial question.

More than two years into the AI boom, big tech companies Meta, Google, Amazon, OpenAI, and Microsoft are in an epic race to build the world’s best AI models and infrastructure. This year, they are on pace to spend around $400 billion on AI infrastructure, with more than a trillion dollars coming behind it. It’s the largest infrastructure spending boom in world history.

Whether Big Tech’s massive investment pays off has become the world’s most important financial question.

AI bears say much of this spending is madness. Companies won’t generate the revenues and profits required to justify it. Once the world realizes this, GDP growth will stall, and the stock market will crash.

AI bulls say, “AI is the most transformative innovation of the century. Big Tech leaders know what they are doing. The bears can’t fathom the amazing and profitable AI applications to come.”

Regular readers know we like to know both sides of any debate about the “fundamentals” of a megatrend. But what the market thinks of those fundamentals is far more important than either side’s beliefs.

You can track and trade what the market thinks of the great “AI Boom or Bust” debate with the VanEck Semiconductor ETF (SMH). This fund owns the world’s largest and most essential chip companies, including AI giants Nvidia (NVDA), Taiwan Semiconductor (TSM), and Broadcom (AVGO).

If the AI bulls are right, this fund goes way higher. If the AI bears are right, this fund goes way lower. As you can see in the chart below, the market still likes the bull case. Today, SMH broke out to new all-time highs. This is the market saying, “Stay long ’cause the bears are wrong.”

We’ll keep tracking SMH — one of the most important charts in the world — to see who is winning the “AI Boom or AI Bust” debate.

No AI bust here… just a powerful uptrend

Are You Making Money in Tech? The Mag 7 Powers to a New All-Time High

Monitoring semiconductors isn’t the only way to gauge what’s happening in the world of AI.

We can also go right to the source of the record infrastructure spending: the “Mag 7.”

In 2023, Bank of America analyst Michael Hartnett began using the term “Magnificent 7” to describe the group of dominant technology firms whose stock returns were far outpacing the broad market. The Magnificent 7 comprises Microsoft, Amazon, Alphabet, Tesla, Apple, Meta, and Nvidia.

If the enormous amount of AI infrastructure spending yields hit commercial products, AI dominance, and huge revenues, the Mag 7 stocks will go up and up and up.

If much of the spending yields little, these stocks will go down.

Above, we pointed to surging semiconductor stocks and said the market likes the “AI Boom” thesis right now. The 1-year chart of the Roundhill Magnificent Seven ETF (MAGS) is also bullish on AI.

Today, MAGS hit a new all-time high. It’s up 123% over the past two years. It’s a bull market in AI. Trade accordingly.

The Mag 7 surges to a new all-time high

Market Notes

- Today’s trading generated more gains for many of the recently highlighted trends.

- We see new highs for the Robotics theme, the Boomer health care theme, and the oil and gas trade.

-

The U.S. data center and infrastructure building boom sent EPC companies

Quanta (PWR), EMCOR (EME), Sterling (STRL), and

Primoris (PRIM) to new highs.

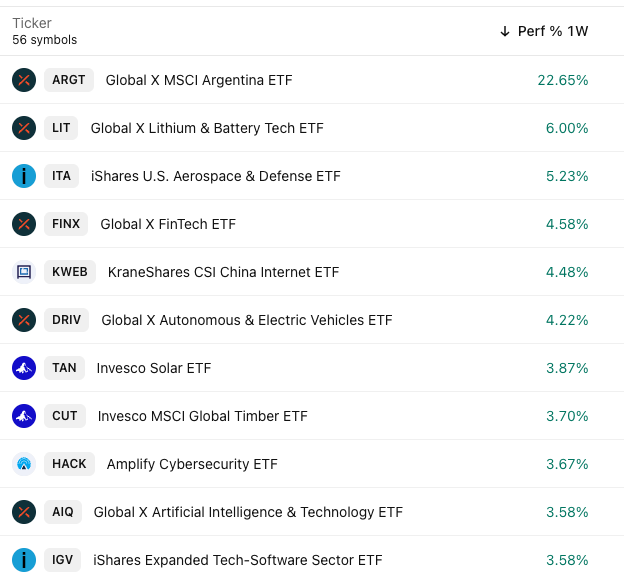

Market Trend Power Rankings

Top performing themes and trends over the past 1 month