Money & Megatrends

October 14, 2025

By Brian Hunt

Inside today’s issue:

- This safe way to play the AI boom just passed a “stress test” with flying colors

- The bears take another one on the chin. Our high horsepower economic indicator is flashing a bright green light

- The uranium megatrend powers to new all-time highs

- The robotics megatrend generates another big winner

This Safe Way to Play the AI Boom Just Passed a “Stress Test” With Flying Colors

The world of big themes and investment megatrends is uncharacteristically subdued today.

After months of powerful themes such as space, AI, psychedelics, cannabis, uranium, gold, and copper registering new highs almost daily, we have few meaningful new highs today.

However, all the themes I just mentioned are trading near new highs. Their uptrends are intact. They were due for a breather. No trend, no matter how strong, runs higher in a straight line without taking breaks.

I received some positive feedback yesterday regarding my review of stocks and trends that held up well in the face of Friday’s major decline. Health care (XLV) held up well. Biotech (XBI) held up well.

Remember, a big decline like the one we saw on Friday is a “stress test” for stocks and trends. If the market drops 3%, you want to see what drops just 1%. If the market drops 2%, you want to see what climbs 1%. This is often called “relative strength.” It allows you to spot the safer megatrends for investment.

It’s like looking at a beachfront neighborhood after a hurricane. Some homes lost their roofs and some homes have blown away. But some homes remained unbothered by the storm. Those are the strongest homes.

Another theme that held up well on Friday and reached a new high today is Electric Power Production (XLU).

Over the past year, I’ve written a lot about AI’s growing electric power needs. The world’s largest and richest companies are investing hundreds of billions of dollars into AI infrastructure. This infrastructure is consuming ever increasing amounts of electricity and will continue to do so in the future. It’s one of our top megatrend “picks to click.”

One way to track and invest in this trend is via the big utility ETF (XLU). This fund holds a diversified basket of major electric power producers such as Constellation Energy (CEG) and Vistra (VST).

As you can see from the chart below, the Electric Power Producer theme is unphased by the recent broad market turmoil. Today, XLU advanced 0.17% to reach an all-time high. This proves how owning electric power producers is one of the strongest and safest ways to invest in the AI boom.

The AI boom drives power producers higher

The Uranium Megatrend Powers to New All-Time Highs

Staying on the nuclear power megatrend (see above), we note today’s new high in the uranium mining group (URA) we follow.

In a 2022 research note, we detailed the upside breakout in key uranium mining stocks and said the group was poised to power higher.

After being vilified for many years, nuclear power is now “back in vogue” with many political and business leaders. Uranium-fueled nuclear power is one of the only viable sources of “always there, always on” baseload power that can power cities and the AI revolution.

Since our note, the uranium mining group has skyrocketed.

Leading uranium players Cameco (CCJ) and Uranium Energy Corp (UEC) are both up more than 200% since our note.

Demand for the fuel is surging on the back of AI power consumption… yet supply is constrained from years of underinvestment in the industry. It’s a recipe for much higher uranium prices over a period of 5+ years.

Trends tend to persist and winners tend to keep winning… so we expect the uranium miner uptrend to continue.

Uranium mining stocks reach a new all-time high

This High Horsepower Indicator Is Flashing a Bright Green Light

In several recent issues, I’ve pointed to the all-time highs in financial stocks and consumer spending stocks as evidence things “can’t be all that bad” with the U.S. economy. If banks and shopping malls are doing great, then the positive forces for economic growth are overpowering the negative forces.

Today, I have another piece of evidence for you. The market just sent shares of Caterpillar (CAT) to a new all-time high.

Caterpillar is one of the world’s largest makers of heavy construction equipment. It makes bulldozers, dump trucks, excavators, generators, and skid loaders. Its fortunes rise and fall with the world’s ability to fund giant infrastructure, real estate, and transportation projects.

The price action of Caterpillar stock is one of my favorite economic indicators. By now, you know I place far more value on stock market prices than I do economic forecasts. The fresh all-time high for one of the world’s most important manufacturing companies tells me that despite some negatives, the economy continues to power along. It shows that “building things” is in a clear megatrend.

Show Cat’s all-time high to your local bear and ask them why they are right and the market is wrong.

Caterpillar’s new high says things can’t be all that bad

Market Notes

- The popular “fake meat” maker Beyond Meat (BYND) reached a new 52-week low today. It’s down more than 99% from its 2023 high. Weak consumer demand for fake meat is making it tough for Beyond Meat to function as an ongoing concern.

And if this poster child of fake, highly processed “meat” should go bankrupt, we at Money & Megatrends will bid it good riddance. We remain “long ribeye.”

-

Gold mining continues its extraordinary 2025 run as a market leader. Today, mega gold miners

Newmont Mining (NEM) and Agnico Eagle (AEM) reached new all-time highs. - Over the past year, I’ve been one of the investment world’s most vocal and emphatic bulls on robotics. It’s been a profitable stance. Today, warehouse robot leader Symbotic (SYM) reached a new all-time high.

- The critical resources megatrend continues minting money for shareholders. US Antimony (USAY) climbed 10% to reach a new all-time high. The stock is up 7,562% since Trump took office.

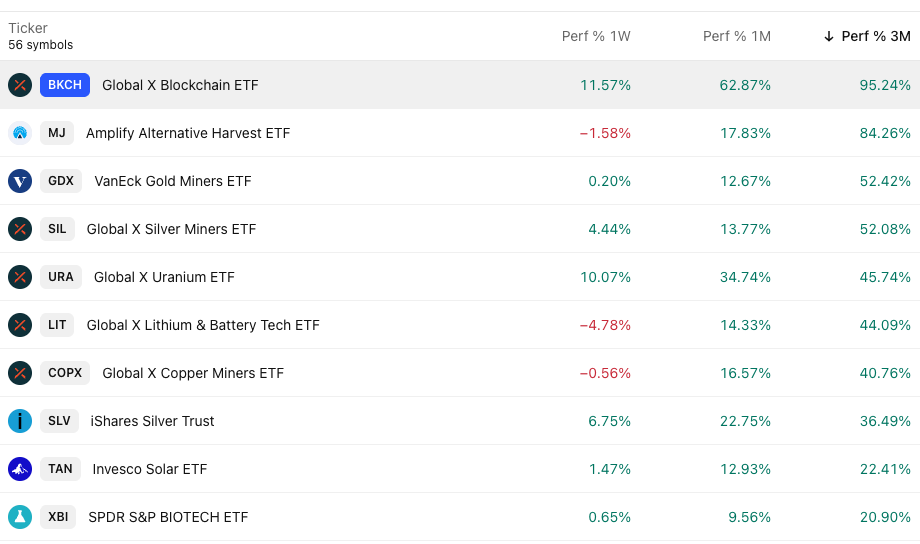

Market Trend Power Rankings

Top performing themes and trends over the past 3 months