Money & Megatrends

October 27, 2025

By Brian Hunt

Inside today’s issue:

- One of the world’s most explosive sectors powers to new highs

- A major development for the critical resources uptrend

- Oil service stocks are up big since our call… did you act and profit?

- Industrial stocks power to new highs. We again ask the “doom and gloom” gurus, Can the economy be all that bad?

The Equal Weight S&P 500 Reaches a New High and Lays Waste to “Narrow Market” Critiques

Today, the S&P 500, the Nasdaq 100, and the Dow Industrials reached new all-time highs. It’s a bull market.

Importantly, it’s a broad bull market… as demonstrated by the S&P 500 Equal Weight Index.

The S&P 500 has been up 69.8% over the past two years. During this run, bearish financial gurus have consistently fought the trend, claiming the market run was “narrow.”

A “narrow” bull market is one in which a small group of stocks account for most of the index’s gains… while most stocks go down or sideways. During this cycle, the top technology stocks have posted giant gains.

But do the bears have a point?

One of the best ways to gauge whether a market is narrow is to look at the performance of the S&P 500 Equal Weight Index. The popular S&P 500 Index you hear about on the news is a “market-cap weighted” index. This means the biggest companies, such as Nvidia and Apple, have outsized effects on the index’s value compared to smaller companies.

An “equal weight” index nullifies those market value-related impacts – assigning equal weight to each stock in an index regardless of the company size.

The chart below shows the past year’s performance of the Invesco S&P 500 Equal Weight ETF (RSP), the market’s largest “equal weight” index fund. As you can see, this fund registered a new one-year high today.

It’s not just a bull market… it’s a broad bull market. Trade accordingly.

It’s a broad bull market

The Power Grid Upgrade Theme Continues to Be One of the World’s Most Powerful and Rewarding Uptrends

Over the past week, the Power Grid Upgrade theme has proven to be one of the world’s most powerful and rewarding uptrends. The First Trust NASDAQ Clean Edge Smart Grid Infrastructure Index Fund (GRID) advanced Friday and today to reach new all-time highs.

On October 7, we introduced this theme as a way to invest in the AI boom.

Regular readers know power consumption is one of the most critical facets of the AI megatrend. Given AI’s enormous promise, the world’s largest and richest companies are embarking on the biggest capex spending cycle in history. Giants like Google, Meta, Microsoft, and OpenAI are spending hundreds of billions of dollars on data centers, AI chips, and other infrastructure components.

All that AI infrastructure is poised to consume huge amounts of electricity. Goldman Sachs forecasts global power demand from data centers will climb 50% by 2027 and by as much as 165% by the end of the decade.

This makes the looming upgrade of the global power grid a huge investment opportunity.

The U.S. power grid is often called the world’s largest machine. It’s an interconnected network of power stations, transmission lines, substations, and wires. Most people barely know it’s there or how it works, but without this big machine, your lights don’t turn on, there’s nothing to watch on Netflix, and your iPhone doesn’t charge.

Industry experts say the power grid is aging and creaking under the strain of increased electricity demand. The American Society of Civil Engineers (ASCE) gave the energy sector a D+ on its 2025 Infrastructure Report Card, citing concerns about growth in energy demand, an aging system, and a lack of transmission capacity.

Soaring electricity demand… a grid badly in need of an upgrade… AI supremacy on the line… trillions of dollars of economic output on the line…

We state again: This is a recipe for a bull market in companies that build, repair, and upgrade our power grid.

This is a broad theme with individual leaders such as Quanta (PWR), Monolithic Power Systems (MPWR), and Eaton (ETN) on the menu. If you prefer ETFs, GRID is an option. We expect this fund’s recent new highs to be followed by more.

The Power Grid Theme advances to a new high

The Biotechnology Revival Theme Surges to a New 1-Year High

After years of struggling, the biotechnology sector is now one of the market’s strongest themes. Today’s trading confirms it. The SPDR S&P Biotech ETF (XBI) climbed 2.5% to reach a new 1-year high. The Biotech Revival is on.

Over the past two months, we’ve frequently highlighted the biotech sector as one of the market’s strongest new trends.

The biotechnology sector is full of companies working on cures and treatments for hundreds of diseases. When investors grow interested in this industry, the returns can be incredible. During the last biotech bull market, the sector soared 300% over four years.

Since biotech has performed poorly since 2021, most investors are indifferent to it. But I see major potential here. I believe this industry could start regularly generating stock market doubles and triples.

The fusion of AI + biology will generate dozens of compelling stock narratives over the coming years. Researchers running super-intelligent AI programs will be able to run millions of digital simulations for every drug and treatment. This will put drug development into overdrive… and create many big stock winners.

Companies that use AI to “crack the code” for various diseases and drugs will enjoy 100%… 500%… even 1,000%+ stock rallies.

In many cases, these rallies will happen thanks to stories and potential… rather than a company generating revenue or earnings.

Remember, capitalizing on many of today’s biggest stock market trends means focusing on promise over profits. The Biotech Revival holds the promise of both. This trend should keep running.

The biotech sector climbs to a new 1-year high

Market Notes

Tech leaders Apple (AAPL), Google (GOOG), Palantir (PLTR), Micron (MU),

Snowflake (SNOW), ASML (ASML), Qualcomm (QCOM), Applied Materials (AMAT),

Corning (GLW), Arm Holdings (ARM), Palo Alto Networks (PANW), Vertiv (VRT),

and Advanced Micro Devices (AMD) reached new 52-week highs.

and Sterling Infrastructure (STRL) reached new 52-week highs today.

The Semiconductor ETF (SMH) reached a new all-time high today.

fund reached a new all-time high.

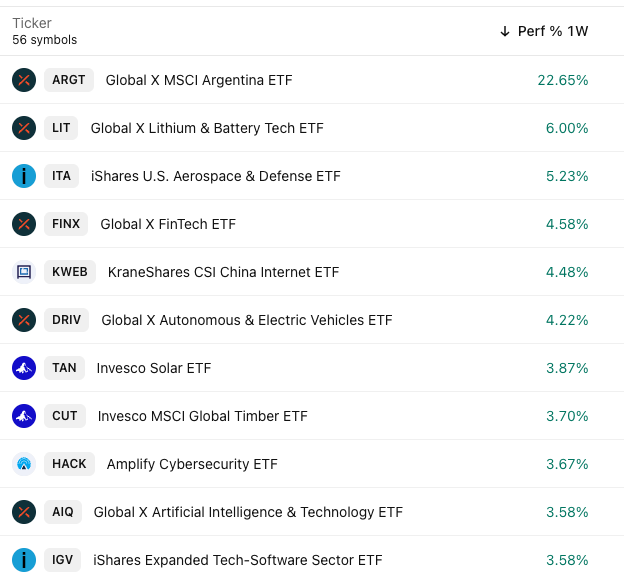

Market Trend Power Rankings

Top performing themes and trends over the past week