Money & Megatrends

November 5, 2025

By Brian Hunt

Inside today’s issue:

- Another EPC theme leader soars to a new all-time high… are you on board?

- The solar energy trade explodes higher, confirming the “AI Power Boom” is one of the world’s most profitable themes.

- Big moves in drug maker stocks confirm Boomer health care is a theme rich with opportunity.

- Brazil advances to another high and confirms the bull market in critical resources.

The Solar Energy Trade Explodes Higher, Confirming the “AI Power Boom” as One of the World’s Most Profitable Themes

Over the past two months, I’ve repeatedly made the case for owning solar energy stocks. Today, we received confirmation that solar is one of the most profitable trends in the entire market.

Regular readers know power consumption is one of the AI megatrends’ largest and most profitable facets. Industry experts believe solar energy can’t compete with nuclear and fossil fuels to supply the enormous amounts of “always on, always there, baseload” power needed for AI data centers.

However, inexpensive and easily installed solar systems can supply smaller individual power consumers, such as homes, offices, stores, and small factories. This means demand for solar power is increasing because AI is driving up the price of other forms of electricity.

That’s the fundamental bullish case.

But around here, the fundamentals of a trend are less important than what the market thinks of a trend. Today, the market told us it loves the solar energy trend. The Invesco Solar ETF (TAN) surged 5% to reach a new 12-month high.

Shares of TAN have increased by an impressive 14% over the past six weeks. Shares of solar giant First Solar (FSLR) are up 25% over the same time. These gains are being driven by AI’s insatiable demand for all forms of energy.

Despite the extraordinary performance of solar stocks over the past 6 weeks, the investment public is indifferent towards the sector. This tells me the trend likely has a lot further to run.

Big moves in drug maker stocks confirm Boomer health care is a theme rich with opportunity

“For a lot of Baby Boomers, a typical month involves going to see at least one doctor to have something looked at, something removed, or something treated.”

This quote from our October 8 briefing summarizes one of the world’s most powerful investment megatrends: Boomer health care.

More than 10,000 Americans reach retirement age every day. That’s the giant Baby Boom generation entering the later stages of life… and a significant opportunity for the health care industry.

Ever since the Boomers hit the scene in 1946, they have been a demographic force to be reckoned with. As they’ve worked through life, they have powered a variety of big industry booms. For example, when Baby Boomers began buying starter homes in the 1980s, it drove housing booms in many cities.

Now, Boomers are in a phase of life where health care and longevity spending skyrockets. As I mentioned, for many Boomers, a typical month involves going to see at least one doctor to have something looked at, something removed, or something treated.

The Boomer generation contains the largest group of wealthy people the world has ever seen. Many of them will spend big bucks pursuing health and extra years. The Boomers that aren’t rich are supported by big government programs.

This means many health care fields are enjoying huge demand now… and will for at least the next decade. It’s going to rain money on many health care businesses.

That is why I’m bullish on health care-related investments.

Over the past month, I’ve highlighted how the market is beginning to like the Boomer health care theme. Health care and drug development stocks are starting to lead the market.

Today’s trading produced more confirmation of this “bull thesis” in the form of new 1-year highs for the iShares U.S. Pharmaceuticals ETF (IHE). This fund holds the “who’s who” in pharmaceuticals. Major holdings include Eli Lilly (LLY), Johnson & Johnson (JNJ), and Merck (MRK).

Given the long-term nature of the Boomer health care theme, we expect to see it generate many more such new highs over the coming years.

An EPC theme leader reports a record quarter and soars to new high… are you on board?

This week, EPC theme leader Sterling Infrastructure (STRL) reported a record-breaking third quarter, driven by a boom in U.S. data center and infrastructure building. Shares soared 6.8% to reach a new all-time high.

It’s further confirmation that the EPC theme is one of the economy’s greatest areas of opportunity.

On October 16, we forecasted that U.S. Engineering, Procurement, and Construction (EPC) stocks would benefit significantly from Donald Trump’s U.S. manufacturing capacity buildout boom.

EPC stands for Engineering, Procurement, and Construction. These firms design and build giant infrastructure projects such as airports, skyscrapers, power plants, subways, and data centers.

These firms are benefitting greatly from Donald Trump’s push to increase U.S. manufacturing capacity. Some of the world’s largest manufacturers are poised to invest over $200 billion in new U.S.-based factories.

The bull case for EPC stocks doesn’t stop there, though. They also have an “AI tailwind” blowing at their backs…

Business and political leaders believe the U.S. is in a “Great AI Race” against China. This race makes it urgent to build data centers and the electric infrastructure required to operate them. Big tech companies such as OpenAI, Microsoft, and Amazon are on pace to spend $400 billion on AI infrastructure this year… with more than a trillion dollars ready to follow.

So, let’s add this up.

The world’s richest, most powerful companies want to spend money on an epic scale. And they want to do it quickly. Plus, a forceful president has staked his legacy and reputation on expanding U.S. manufacturing capacity and winning the AI race.

This means the bidding process for many infrastructure building projects will consist of EPC companies throwing out absurdly high $100 million+ bids… then Big Tech or the White House replying, “Sure, we’ll take five of them. Can you start yesterday?”

It appears Trump will get his manufacturing and AI data center building boom. This makes EPC companies such as Sterling a good “megatrend” bet.

An EPC leader soars to a new all-time high

Market Notes

- Today, the iShares Brazil fund (EWZ) – heavily weighted towards critical resource stocks – advanced 2% to reach a new 1-year high. This confirms the bull market in critical resources.

- AI semiconductor leader Micron (MU) climbed to a new all-time high today. The AI bulls continue their winning streak.

- Oil giant BP (BP) reached a new 1-year high today. This indicates that the nascent bull market in oil stocks is gaining momentum.

- The AI-driven bull market in “all forms of electricity” is alive and well… geothermal energy leader Ormat (ORA) reached a new 1-year high today.

Regards – and remember – trends tend to persist.

Brian Hunt

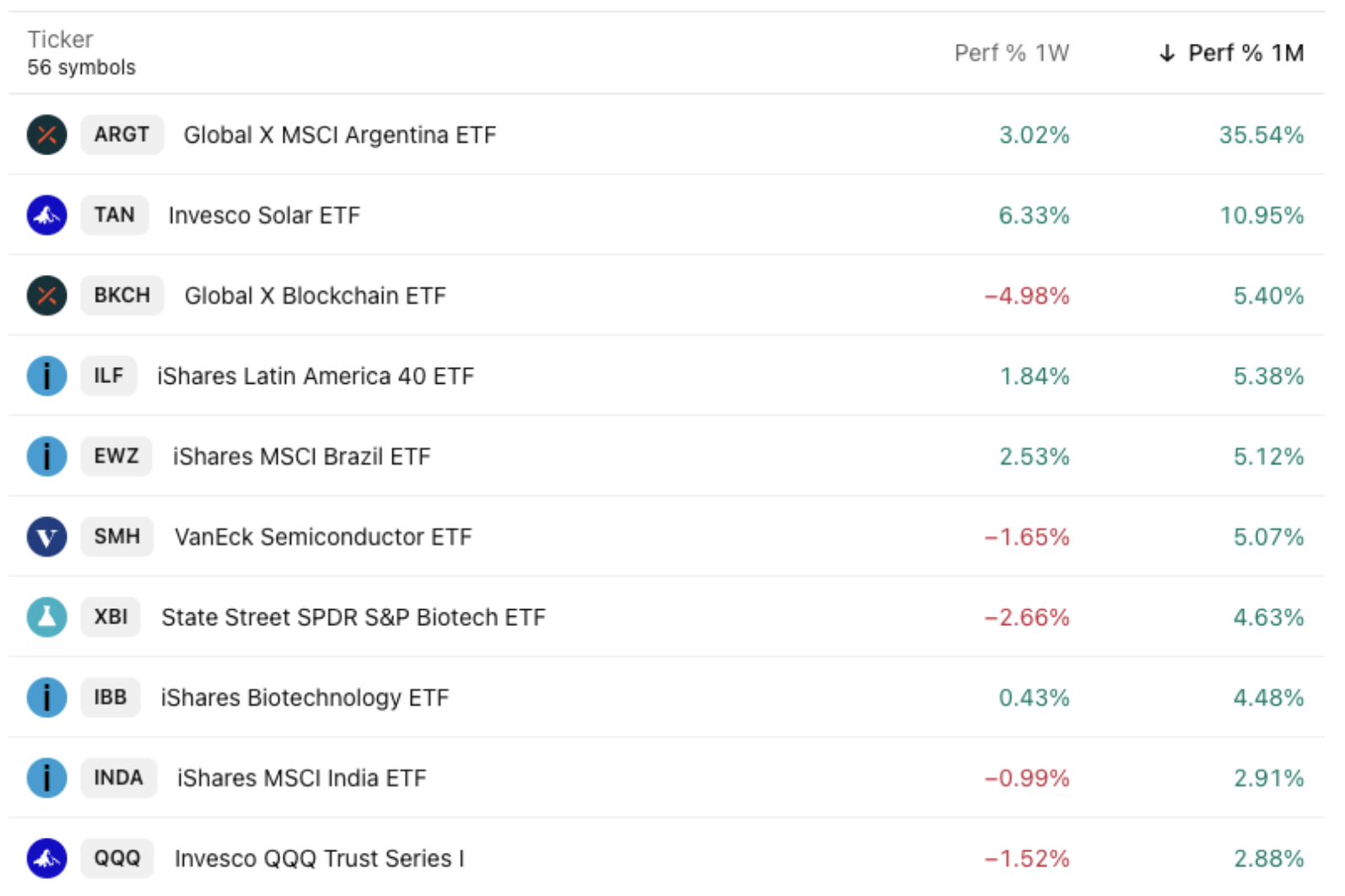

Market Trend Leaderboard

![[Pill bottle spilled on the counter]](https://corporate.marketwise.com/wp-content/uploads/2025/11/PillBottle.png)

![[STRL Stock Graph]](https://corporate.marketwise.com/wp-content/uploads/2025/11/STRLStockGraph.png)