Money & Megatrends

October 28, 2025

By Brian Hunt

Inside today’s issue:

- One of the world’s most explosive sectors powers to new highs

- A major development for the critical resources uptrend

- Oil service stocks are up big since our call… did you act and profit?

- Industrial stocks power to new highs. We again ask the “doom and gloom” gurus, Can the economy be all that bad?

This End-of-Year Stock Market Bet Has a High Probability of Winning

On Monday, the Nasdaq 100, the S&P 500>, and the Dow Industrials hit new all-time highs. Trends tend to persist, and winners tend to keep winning, so we’re still bullish. But the near-term outlook for stocks gets even more bullish…

We have entered the best rolling three-month period to own stocks: October 27 to January 7. And this year, the market is entering this period with positive momentum… which is typically very bullish.

One of my favorite analysts – Wayne Whaley – recently shared that the stock market is up over 10% over the past 12 months heading into the October 27 – January 7 window.

This kind of setup – when the market is up 10%+ going into this period – has happened 40 times over the past 75 years. In 39 of those 40 instances, stocks saw positive returns in the following October 27 – January 7 stretch, with an average return of 5.89%.

Given this bullish setup, the issue isn’t whether to be long, but how to be long. Which themes and sectors should we own as we go into 2026?

As usual, I want to own the strongest themes with the greatest upside potential, the strongest revenue growth, and the best narratives that will attract investor capital.

This means owning the themes I’ve covered repeatedly over the past few months:

- The Power Grid Upgrade theme

- The Robotics theme

- The AI Power theme — including its component areas of solar, nuclear, and natural gas

For example, the solar energy chart looks great.

In our September 23 issue, I made the case for owning solar.

Solar energy can’t compete with nuclear and fossil fuels to supply huge amounts of “always there, baseload” power. However, cheap and easily installed solar systems can supply smaller individual power consumers like homes, offices, stores, and small factories. The IEA forecasts that the amount of installed renewable power (much of it solar) will more than double by 2030.

That’s the fundamental case.

Regular readers know I believe fundamentals are less important than what the market thinks of a trend. Right now, the market likes the bull case for solar stocks. The Invesco Solar ETF (TAN) is in a strong uptrend and is close to hitting a new 12-month high.

The odds greatly favor stocks going higher into January. You can play it with a broad market bet (Nasdaq 100, QQQ) or with individual thematic bets, such as solar. A bet today could make for a happy New Year.

The solar trade is set to make new highs

This Industry Is Guaranteed to Enjoy Soaring Revenues

It’s a very safe bet that in the future, we will see massive growth in the use of AI applications, industrial robotics, AI health care management, autonomous vehicles, and air taxis.

The guaranteed hypergrowth of these trends also means increased cybersecurity spending is inevitable.

In 2022, I named cybersecurity as one of our top megatrends for investment. The bull case back then (as it is now) is simple: The exponential age must be safe for it to thrive. You must believe your data will be safe to buy from Amazon, use ChatGPT, download apps to your phone, get into a driverless Waymo, and enter your medical history into an iPad.

I even went so far as to say increased cybersecurity spending is “inevitable.”

“Inevitables” is a concept popularized by legendary investor Warren Buffett.

It’s his term for big companies that dominate their industries. These companies have such well-entrenched and well-defended positions in the marketplace that their continued success is virtually inevitable. This makes “inevitables” excellent long-term investments that allow you to make big money while still sleeping well at night.

I like to apply Buffett’s concept to megatrend investing. We want to invest in massive business and technological trends with such bright futures… such large addressable markets… and so much guaranteed future demand that the trend’s growth is “inevitable”… virtually guaranteed.

In June 2022, I named Palo Alto Networks (PANW) and CyberArk (CYBR) as two stocks to play the inevitable increase in cybersecurity spending. Since our note, CyberArk is up 280% and Palo Alto is up 164%. Both of these cybersecurity leaders reached new all-time highs today.

Below, we see the strong uptrend in cybersecurity stocks, represented by the Amplify Cybersecurity ETF (HACK). It’s an uptrend powered by the “inevitable” growth in cyber defense spending. Isaac Newton was right: An object in motion tends to stay in motion, and trends tend to persist.

Increased cybersecurity spending is inevitable

Market Notes

- Giant technology leaders Apple (AAPL) and Google (GOOG) reached new all-time highs today. The broad technology uptrend is alive and well.

- Financial giants Bank of America (BAC) and Morgan Stanley (MS) reached new all-time highs today. We ask the apocalyptic bears this question: Can things be all that bad if America’s most important banks and investment firms are enjoying soaring revenues and market values?

We think not!

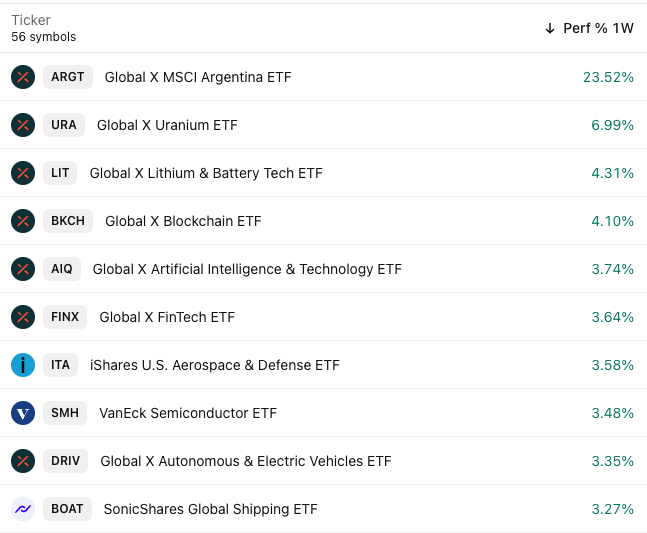

- The Global X MSCI Argentina ETF (ARGT) is the top performing fund in our Global Trend Tracker database over the past five days. The free market-oriented Javier Milei recently scored a big electoral win, which is driving Argentine stocks higher. We are rooting for this fund to soar hundreds of percent from here.

Market Trend Power Rankings

Top performing themes and trends over the past week