Money & Megatrends

October 22, 2025

By Brian Hunt

Inside today’s issue:

- This one chart shows it’s a bull market in U.S. manufacturing

- The Boomer health care theme posts another new high. This is what a wealth-creating megatrend looks like.

- The oil and gas sector is making another run at “bull market” status

This One Chart Shows It’s a Bull Market in U.S. Manufacturing

Over the past two months, I’ve frequently highlighted what the market is saying about one of the world’s most important financial issues: The state of the U.S. economy.

Today’s reader of financial research and news can find many convincing “takes” from both bulls and bears. Bulls point to AI-fueled innovation and solid corporate earnings as reasons to be optimistic. Bears point to government deficits and too much AI spending as reasons to be pessimistic.

Although it’s good to know why a market or an economy may go down or up, those reasons are much less important than what the market thinks of them. Fundamentals ride in the backseat. Price drives the car. You can be bullish or bearish on a market until you’re blue in the face, but if the market isn’t moving in your preferred direction, you have a losing idea.

Recently, I’ve pointed to the bull market in heavy equipment maker Caterpillar (CAT) and large banks such as JPMorgan (JPM) as evidence that the economy “can’t be all that bad.”

Looking at American manufacturing today, we get the same message.

The chart below shows the past year’s price action in the iShares U.S. Manufacturing ETF (MADE). This fund owns a diversified basket of major U.S. manufacturing firms, including Honeywell (HON), TE Connectivity (TEL), PACCAR (PCAR), Eaton (ETN), and General Motors (GM).

These companies make car parts, air conditioners, valves, tools, robots, industrial chemicals, generators, airplane parts, heavy trucks, tractors, and electrical equipment. Their fortunes rise and fall with U.S. economic health.

As you can see in the chart, the fortunes of U.S. manufacturers are rising. Yesterday, MADE reached a new all-time high, driven by many of MADE’s holdings reporting solid earnings and forward guidance.

The economic pessimists will be right someday. The business cycle moves in ups and downs. But right now, the pessimists are wrong and we’re moving up.

It’s a bull market in U.S. manufacturing

The Boomer Health Care Theme Posts Another New High. This Is What a Wealth-Creating Megatrend Looks Like.

Today, we received more confirmation that “Boomer health care” is a strong theme you want to own.

Over the past month, we’ve frequently highlighted the market-leading performance of health care and drug development stocks in 2025.

The bull case here is simple and powerful: More than 10,000 Americans reach retirement age every day. That’s the giant Baby Boom generation entering the later stages of life.

Boomers are in the stage of life when spending on health care and longevity skyrockets. For many boomers, a typical month involves going to see at least one doctor to have something looked at, something removed, or something treated.

This means many health care fields are enjoying huge demand now… and will for at least the next decade. It’s raining money on many health care businesses right now and will continue to do so for years.

Importantly, the market keeps agreeing with our thesis. The SPDR Health Care ETF (XLV) reached a new multi-month high today. According to our Global Trend Tracker database, it’s one of the top-performing themes of the past month.

As you can see in the chart below, XLV is resuming a multi-year uptrend powered by the aging Baby Boomers. This is what a wealth-creating megatrend looks like.

The Boomer health care theme and its uptrend

The Oil and Gas Sector Is Making Another Run at “Bull Market” Status

On September 29, we highlighted the emerging leadership of oil and gas stocks and stated it’s time to be long this sector.

The bull case for oil stocks is simple. If the global economy is growing, oil demand will remain solid. But importantly, U.S. shale oil production growth looks like it is peaking. This would remove a reliable source of production growth that has been in place for over a decade. Plus, oil is very cheap relative to gold and other assets, indicating good value in oil.

Our original note said the upside breakout in oil stocks was a bullish new development. That breakout was met with selling, which sent the sector back into its sideways consolidation area.

As the chart below shows, oil stocks are making another attempt at “bull market” status.

Today, the SPDR Oil & Gas Equipment Services ETF (XES) hit a new six-month high. This fund owns a diversified basket of companies that sell all kinds of oil and gas drilling equipment and services, including land-based drilling rigs, offshore oil drilling platforms, drilling ships, pumps, pipes, and valves.

XES’s recent price strength is particularly notable in that it’s happening during a period of crude oil price weakness. Over the past month, crude oil has dropped 8% and reached a multi-month new low. This tells us that despite the short-term weakness in oil, large oil companies are still spending on exploration.

Another factor that makes me want to place a bet here is investor sentiment. Sentiment towards oil and oil stocks can be charitably described as “indifferent,” which is bullish. I’m long.

Oil service stocks take another run at “bull market” status

Market Notes

- A bullish sign for the U.S. economy: Giant retailer Macy’s (M) reached a new 52-week high today.

- Another bullish sign for the U.S. economy: Credit card giant American Express (AXP) reached a new 52-week high today.

- Yet another bullish sign for the U.S. economy: Auto giant Toyota (TM) hit a new 52-week high today. (The U.S. market represents a considerable portion of Toyota sales.)

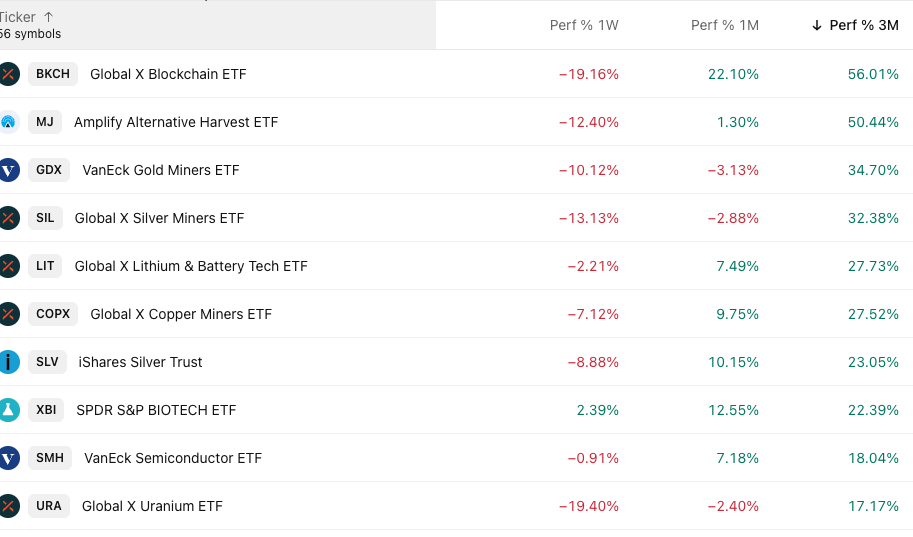

Market Trend Power Rankings

Top performing themes and trends over the past 3 months