Money & Megatrends

October 3, 2025

By Brian Hunt

Inside today’s issue:

- The Tokenization theme is poised to generate major public interest and send related plays much higher. Are you positioned to benefit?

- A massive new development for the AI trade

- The drone megatrend powers to another new high

- Critical resource plays are skyrocketing

The Tokenization Theme Is Poised to Generate Major Public Interest and Send Tokenization Plays Much Higher. Are You Positioned to Benefit?

Over the past year, the concept of “tokenization” of assets has generated increasing amounts of investor interest. The current “buzz” surrounding this trend is poised to turn into a roar and generate large stock and crypto winners.

Below, we explain why this is a trend worth betting on.

The “token” in tokenization means fractional ownership of an asset… like fractional ownership of a business via a share of stock. Thanks to innovation in blockchain technology, we are on the verge of “carving up” ownership in all kinds of assets like real estate, private businesses, collectible cars, wine, jewelry, art, and sports teams… and trading them like stocks.

Stocks and bonds can be tokenized as well, which could allow non U.S. investors to easily buy and sell them.

Tokenization bulls say this trend is poised to create the biggest change to capitalism in a century. Imagine a world where you can buy and sell ownership stakes in real estate, collectibles, art, and sports teams anytime you like. A world of valuable assets would become available to the investment masses.

Tokenization also holds the promise of a “sci-fi” kind of world where individuals can sell ownership stake in themselves. For example, you could sell the rights to a piece of your future earnings for $500,000… and those rights could trade on an exchange. Their value would rise and fall along with your earnings power as you go through life.

This new way of owning, buying, and selling assets would restructure how we do business, earn income, order society, and invest.

Anyway, that’s the promise. That’s the hype. But regular readers know we place much more value on what the market thinks of an idea than what bulls or bears think of an idea. We care more about what price action is doing… what the trend is doing.

Many tokenization experts point to cryptocurrencies Ethereum and Solana as two good ways to invest in this potential boom. These cryptos serve as key infrastructure for tokenization. Or, if you won’t buy cryptos (Okay Boomer), remember that innovative brokerages like RobinHood (HOOD) and Coinbase (COIN) also stand to benefit from tokenization.

A look at Ethereum and Solana (respective charts below) show that both are near – but not at – new highs. Should Ethereum break $4,800 and should Solana break $260, I’d take it as a message from the market that the tokenization theme is ready to run.

A Massive New Development for the AI Trade

In yesterday’s Market Notes, we highlighted the new highs in three of the world’s most important companies. Nvidia (NVDA), Taiwan Semiconductor (TSM), and ASML (ASML).

We noted how these firms are “linchpins” of the AI semiconductor supply chain… and how their new highs tell us the AI theme is alive and well.

The significance of this new development cannot be overstated. So, let’s discuss this big development a bit more.

Nvidia is the world’s leading AI semiconductor chip designer… which has made it the world’s most valuable company. But Nvidia does not own and operate the factories that produce “Nvidia chips.”

Much of Nvidia’s production work is performed by the world’s biggest chip manufacturer Taiwan Semiconductor. To perform this critical and valuable work, Taiwan Semiconductor must purchase very large, very high-tech and very expensive chipmaking machines from ASML, which holds a monopoly on such machines.

Together, these three interlocked companies represent a giant portion of the world’s AI infrastructure. And all three of them just registered new 12-month highs… plus new all-time highs in the cases of Nvidia and TSM.

Now that AI is all over the mainstream press and has generated many giant winners over the past few years, bears and naysayers are coming out of the woodwork to say this trend is poised to end.

To this, we say that yes, all good things must come to an end. Trees don’t grow to the sky. But for now, this theme is booming. And we’re siding with the market on this one. The market is saying to the AI bears, “Have fun missing out. Have fun being poor.”

AI semiconductor leader Taiwan Semi reaches a new all-time high

One of Our Top Megatrend Calls Just Generated 252% Gains. We See More Upside Ahead.

The vast wealth created at warp speed by AI-related stocks is one reason why tell readers at least once per week that, “Right now, you can make big money in stocks faster than at any time in history.”

Stocks of all kinds are moving much faster than they used to.

This is thanks to fusion of three modern day phenomena. There’s blazing exponential progress in technology. There’s how business and stock market information now gets disseminated at light speed. And there’s the fact that thanks to high frequency trading and smartphone enabled trading, people can execute rapid trades from anywhere.

Add those up and you get a market that moves much, much faster than it did 20 years ago. Put another way, “This is not your father’s stock market.”

One example of stocks moving fast is related to one our major “megatrend calls” from 2024.

In late 2024, I urged colleagues to own drone stocks. The reason was simple: After years of progress and innovation, military and surveillance drone makers can now produce large amounts of effective drones at low cost. Many drone applications now have very high “cost-to-damage inflicted” ratios. This is why drones have played a huge role in the Russia/Ukraine war.

The now pervasive use of drones in warfare means we are in what military experts call a “Revolution in Military Affairs (RMA).”

A Revolution in Military Affairs is a fundamental change in how wars are fought. They are typically driven by technological innovation. For example, the introduction of mechanized warfare in the form of tanks, battleships, and airplanes drastically changed the battlefield.

As someone that is deeply anti-war and anti-surveillance, a big part of me wants to see nobody buying drones except for ones that deliver pizza and Amazon packages. However, I don’t make the rules. Governments around the world are buying drones like crazy. Drone maker revenue is soaring. We have an investment megatrend on our hands.

One stock I’ve highlighted to play the drone megatrend is Kratos Defense & Security Solution (KTOS). Kratos is a big maker of aerial combat and surveillance drones. It has world-class revenue growth and climbed 10% over the past 5 trading sessions to reach a new all-time high. The stock is up an incredible 252% since December 2024.

Other drone winners since December include AeroVironment (AVAV), up 124%, and Ondas Holdings (ONDS), up 1,032%.

The drone trend will last for years… so more gains are likely ahead. And this giant rally is a reminder that right now, you can make big money in stocks faster than at any time in history.

Killer flying robots can make you money. Kratos hits a new high

Market Notes

- Partnering with the U.S. government to supply critical resources continues to generate profits in the rare earth industry. Today, the rare earth mining group (REMX) we follow climbed 6.37% to reach a new 12-month high. It’s up 90% since our first note on this theme in June. Not bad for under four months!

- Over the past year, we’ve pounded the table and then some on the robotics theme. Today, two of the robotics ETFs we follow (ROBO, BOTZ) reached new all-time highs.

- The “China tech” trade we’ve pounded the table on continues to produce gains. Chinese tech giants Alibaba (BABA) and Baidu (BIDU) just reached new 12-month highs.

- Providing yet another sign the global economy “can’t be all that bad,” construction equipment giant Caterpillar (CAT) reached a new 12-month high today.

- The critical resources uptrend is alive and well. Today’s piece of evidence is another new 12-month high for the Copper mining group (COPX) we follow.

- The biotech theme we’ve highlighted many times recently is alive and well… small cap biotech fund (XBI) just reached another 6-month high.

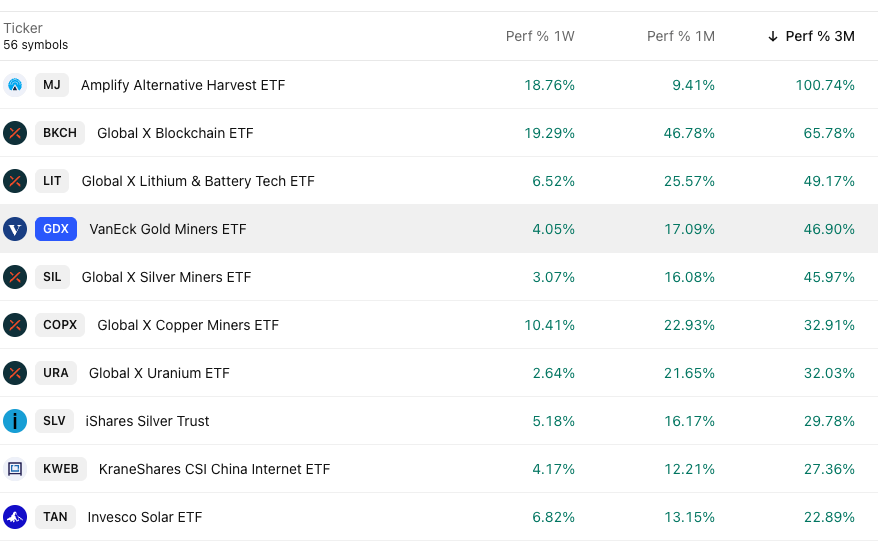

The Trend Leaderboard

Top performing themes and trends over the past 3 months