Money & Megatrends

October 13, 2025

By Brian Hunt

Inside today’s issue:

- Trump vs. China sends the critical resources megatrend to new highs

- The Baby Boomer health care theme holds up during Friday’s “stress test”

- The Nuclear Buildout theme soars to a new high… are you on board?

Trump vs. China Sends the Critical Resources Megatrend to New Highs

On Friday, Trump smashed the stock market with his tweet about China and tariffs. The S&P 500 dropped 2.7%, its worst day since April. The Nasdaq 100 dropped 3.47%.

The high-growth, fast-moving themes and sectors fell more than 4%. I put space, solar, psychedelics, semiconductors, robotics, and blockchain in this group. High-growth trends dropping more than the broad market is a normal occurrence on big down days.

At the center of the current beef between Trump and China is critical resources — specifically, rare earth elements critical for military and robotics applications.

Regular readers are familiar with this situation. I’ve put it like this: Donald Trump has staked his legacy and reputation on massively expanding U.S. manufacturing capacity. The Trump & Friends administration is working with business leaders to invest trillions in pursuit of this goal.

However, there’s a big problem with any plan to increase domestic manufacturing capacity: We don’t have the critical resources we need to build the required infrastructure.

We don’t have the copper, iron ore, rare earths, lithium, antimony, nickel, and other vital building blocks required to build all those data centers… all those factories… all those robots… all those electric grids… all those power plants… and so on.

It’s like we very much want to build a big house… but we don’t have the lumber, the screws, or the nails we need to make it happen. Solving this problem is possible… and it is an enormous financial opportunity.

Companies working on the solution to this problem have rallied massively over the past few days. US Antimony is up 29% today and reached a new high. MP Materials is up 23% today and reached a new high. Over a dozen of their fellow critical resource firms are up more than 10% today.

The rare earth group we follow (REMX) is up 14% today and reached a new high. It is up 104% since we introduced this trend in June.

We stand by our original thesis: Partnering with the U.S. government to increase domestic and friendly-country supplies of critical resources will prove to be one of the most lucrative financial activities of this decade.

The critical resources megatrend continues to generate gains

The Baby Boomer Health Care Theme Holds Up During Friday’s “Stress Test”

After a horrible day like Friday, I like to look and see what stocks, ETFs, and themes held up well. It’s a “stress test.”

If the market drops 3%, you want to see what drops just 1%. If the market drops 2%, you want to see what climbs 1%. That sort of thing. This is often called “relative strength.” It allows you to spot the safer megatrends for investment.

It’s like looking at a beachfront neighborhood after a hurricane. There are some homes that lost their roofs and some homes that have blown away. But there are some homes unbothered by the storm. Those are the strongest homes.

Looking at our Global Theme Tracker, we see how both health care and biotech held up well on Friday. The big health care fund we follow (XLV) was down just 1.4%. As I’ve detailed in the past, this theme is a bet on members of the giant Baby Boom generation aging and spending more on health care and longevity.

Also, the small cap biotech fund we follow (XBI) was down just 1.4%. This fund continues to be one of the market’s strongest leaders.

As someone long the health care and biotech themes, I like to see these displays of relative strength. If you’re looking for a silver lining in Friday’s horrible selloff, this is one of them.

Biotech holds up well during Friday’s thrashing

Gold and Gold Stocks Continue Leading the Market

Then there’s gold. This morning, it jumped past $4,100 per ounce to reach a new all-time high. This is another one of the market’s strongest trends.

Regular readers are familiar with gold’s bullish drivers. The governments of most wealthy Western nations have promised far too many things to far too many people.

The related debts and obligations governments have taken on cannot be paid back with sound money. They can only be paid back with debased, devalued money… much of which is created out of thin air. This is driving inflation and significant currency debasement. Prices are going up because the value of our money is going down.

Gold is now up 47% YTD. This tremendous rally continues to drive a corresponding rally in gold mining stocks.

The gold mining stock group we follow (GDX) is trading within a whisker of its all-time high. Although gold stocks are up big this year, the vast majority of investors are indifferent toward this sector. The people on the sidelines will likely provide buying fuel later. I’m still long.

Gold stocks are leading the market and trade near all-time highs

The Nuclear Buildout Theme Soars to a New High… Are You on Board?

Another area of tremendous strength we should note is the Nuclear Buildout theme.

Regular readers know one of the largest and most profitable facets of the AI megatrend is power consumption. Given AI’s enormous promise, the world’s largest and richest companies are embarking on the biggest capex spending cycle in history. Giants like Google, Meta, Microsoft, and OpenAI are spending hundreds of billions of dollars on data centers, AI chips, and other infrastructure components.

All that AI infrastructure is poised to consume huge amounts of electricity. We quote the International Energy Agency:

“… electricity demand from data centres worldwide is set to more than double by 2030 to around 945 terawatt-hours (TWh), slightly more than the entire electricity consumption of Japan today. AI will be the most significant driver of this increase, with electricity demand from AI-optimised data centres projected to more than quadruple by 2030.”

Given this outlook, AI companies and their electric power providers are spending huge amounts of money on expanding nuclear power capacity. Nuclear can provide huge amounts of “always on, always there” carbon-free baseload power. Bloomberg reports that surging demand will drive $350 billion in nuclear spending in the U.S. by 2050.

I often say you want to live and invest in areas of the economy where it is raining money. You want to work and invest in super booms where money is flowing freely.

The nuclear power industry is one such area. The chart below shows the uptrend in the Range Nuclear Renaissance ETF (NUKZ). This fund owns a selection of nuclear power providers, nuclear fuel miners, nuclear power equipment makers, and nuclear plant builders. As you can see, this fund shrugged off Friday’s selloff and just reached a new all-time high.

Market Notes

- The quantum computing trade we introduced in September continues to be a giant winner. Quantum leaders

Rigetti (RGTI) and D-Wave (QBTS) both surged more than 10% today to reach all-time highs.

Rigetti is up 165% since our note. D-Wave is up 105% since our note. - Back in March, we pointed to the new upside breakout in silver and reminded investors that “the trend is your friend”

for the precious metal. Since our alert, silver has soared 49%. The metal just broke out to a new high north of $50 per ounce.

Market Trend Power Rankings

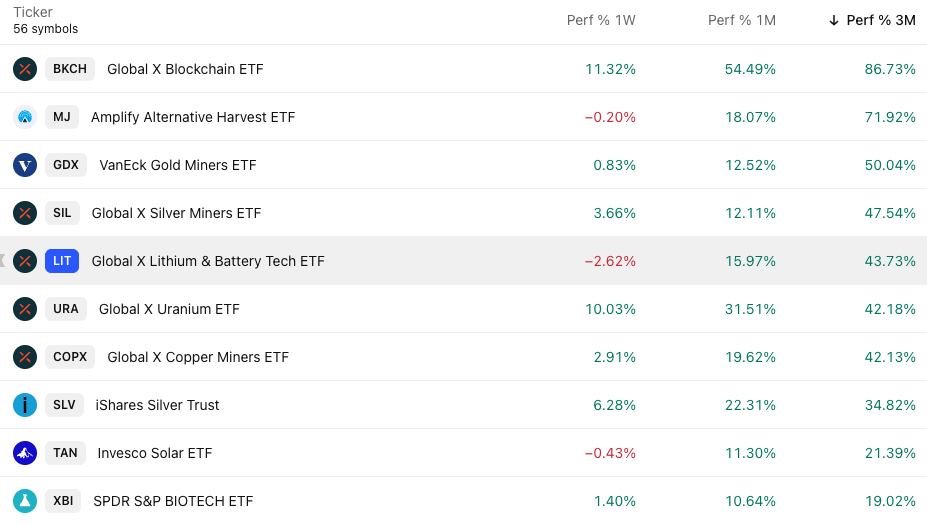

Top performing themes and trends over the past 3 months