Money & Megatrends

October 16, 2025

By Brian Hunt

Inside today’s issue:

- Why “EPC” companies could become some of the market’s hottest stocks

- An out of favor facet of the AI Power trade is generating big returns

- Biotech stocks continue leading the market

Why “EPC” Companies Could Become Some of the Market’s Hottest Stocks

This week, Stellantis (parent company of Chrysler and Jeep) announced plans to invest $13 billion in U.S. manufacturing facilities over the next four years.

This puts Stellantis in a long line of companies set to make very large investments in U.S. manufacturing capacity. Trump & Friends like to tout how they’ve secured over $5 trillion worth of these deals.

Trump is like most politicians. He tends to exaggerate. But it’s looking more and more like we’re going to see a U.S. manufacturing and infrastructure building boom over the next decade. This is great for EPC companies… and a trend worth betting on.

EPC is an acronym for Engineering, Procurement, and Construction. These firms design and build giant infrastructure projects such as airports, skyscrapers, power plants, subways, and data centers.

It’s clear that both business and political leaders believe the U.S. is in a “Great AI Race” against China. This means there’s extreme urgency behind building data centers and the electric infrastructure required to operate them. Big tech companies such as OpenAI, Microsoft, and Amazon are on pace to spend $400 billion on AI infrastructure this year… with more than a trillion dollars ready to follow.

So let’s add this up. You have the world’s richest, most powerful companies wanting to spend money on an epic scale. And they want to do so with extreme urgency. Plus, you have a forceful president that has staked his legacy and reputation on expanding U.S. manufacturing capacity and winning the AI race.

This means the bidding process for many infrastructure building projects will consist of EPC companies throwing out absurdly high $100 million+ bids and Big Tech or the White House replying, “Sure, we’ll take five of them. Can you start yesterday?”

Leading EPC companies set to benefit from a U.S. infrastructure spending boom include Jacobs Solutions J, AECOM ACM, Fluor FLR, Wildan WLDN, Sterling Infrastructure STRL, and Quanta (PWR).

These companies design and build a wide variety of major infrastructure projects. All have well above-average revenue growth that could last for years.

It looks like Trump will get his manufacturing and AI data center building boom. This makes EPC companies a good “megatrend” bet.

EPC leader Sterling nears a 52-week high

An Out of Favor Facet of the AI Power Trade Is Generating Big Returns

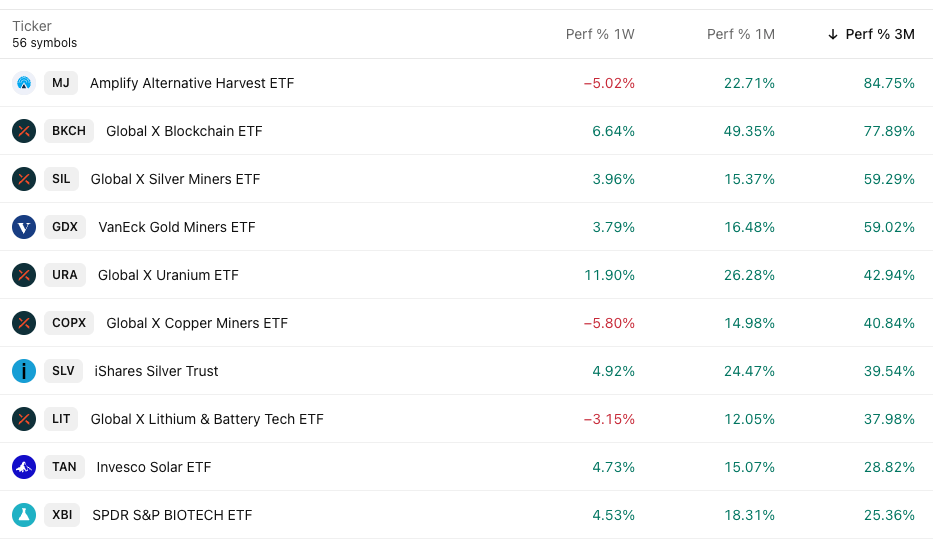

When I’m trying to get a handle on what themes are working at any given time, one “go to” data source is the 1-month performance column in our Global Trend Tracker database.

Our Global Trend Tracker monitors over 70 ETFs that represent most every theme, trend, and asset class you can think of. Twenty years ago, I probably would have said look at 6-month or 12-month performance to get a feel for market trends. But the market moves so fast these days, I say look at 1-month returns or 3-month returns. That will give you the best handle on the market.

I bring this up because today’s top 1-month performer column shows that solar energy stocks are in the top ten. If you’ve been reading Money & Megatrends for a while, you might have expected to see this.

In our September 23 issue, I made the case for owning solar. This sector is now wrapped up in the AI power trade.

Regular readers know power consumption is one of the AI megatrends’ largest and most profitable facets. Given AI’s enormous promise, the world’s richest companies are embarking on the biggest capex spending cycle in history. Giants such as Google, Meta, Microsoft, and OpenAI are spending hundreds of billions of dollars on data centers, AI chips, and other infrastructure components. All that AI infrastructure is poised to consume vast amounts of electricity.

I covered how industry experts believe solar energy can’t compete with nuclear and fossil fuels to supply huge amounts of “always there, baseload” power. However, cheap and easily installed solar systems can definitely supply smaller individual power consumers like homes, offices, stores, and small factories.

That’s the fundamental case.

But around here, the fundamentals of a trend are less important than what the market thinks of a trend. Right now, the market likes the bull case for solar stocks. This week the Invesco Solar ETF (TAN) broke out to a new 12-month high. TAN is up a big 15% in just the past month.

One special thing makes me extra interested in solar stocks. There’s a pervasive belief that Trump & Friends are not supportive of solar energy. The U.S. government is phasing out some important financial incentives that support solar energy. Yet… solar stocks continue to rise.

When an industry group rises during a time it seems it should not, then you have a powerful uptrend on your hands. That’s what’s happening in solar right now… yet the public is indifferent. I’m still long solar.

Buying solar stocks was a bright idea

Market Notes

- The biotech theme we’ve highlighted many times recently continues to pay off. This week, the small cap biotech fund (XBI) reached a new 12-month high. It’s up 26% in the past three months.

- The bull market in gold mining stocks powered to another new high today. The gold miner fund we follow (GDX) is up an incredible 144% YTD.

- The nuclear power trade continues to generate returns. Leading uranium miner Uranium Energy Corp (UEC) climbed 2% today to reach a new all-time high. UEC is up 115% over the past 12 months.

- The “Space Trade” we highlighted on September 22 is running higher. Space leader AST SpaceMobile (ASTS) climbed 3% today to reach a new all-time high. It’s up 250% over the past 12 months.

Market Trend Power Rankings

Top performing themes and trends over the past 3 months