Money & Megatrends

October 29, 2025

By Brian Hunt

Inside today’s issue:

- Why you should be betting big on technology stocks

- One of the world’s most important manufacturing companies blows away estimates and soars to a new high

- Are you long enough? Stocks around the world soar to new highs.

- Our EPC theme continues to reward shareholders. Did you get in?

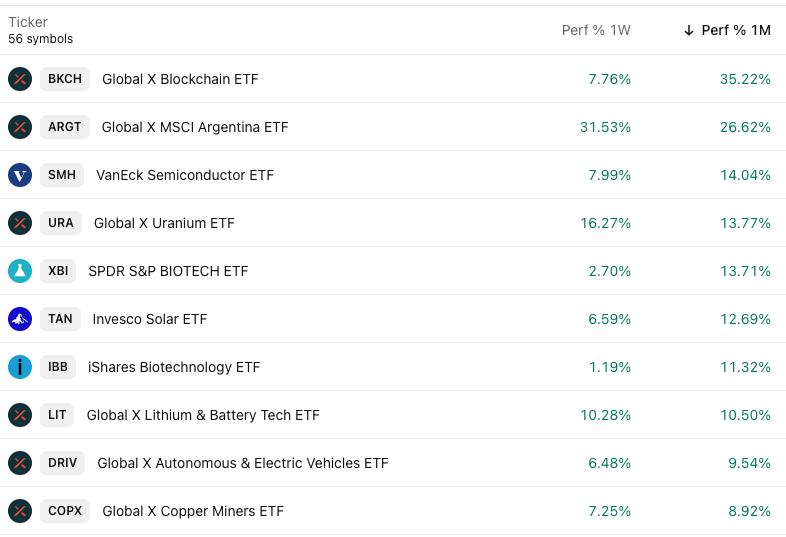

Why You Should Be Betting Big on Technology Stocks

This week, the stock market is sending a loud and clear message to anyone willing to listen…

We are in a rip-roaring super boom in all things technology.

Artificial Intelligence. Autonomous Vehicles. Robotics. Data Centers. Blockchain. Genomics. It’s all booming.

I often say one of the great “cheat codes” of life is to work and invest in industries enjoying so much investment inflows and revenue growth… in trends that are so compelling and impactful to the world… that you can practically fall ass backwards into money.

When you have a booming megatrend working in your favor as an investor, employee, or entrepreneur, success comes easier and faster than it would otherwise. When you have a megatrend working in your favor, even your morning coffee tastes better.

You want to live where it’s raining money.

Right now, we have a megatrend in many areas of technological innovation.

The supporting facts:

- Big robotics supplier Teradyne (TER) reported fantastic quarterly revenue growth. The stock popped 14% to reach a new 52-week high.

- Major AI semiconductor players Nvidia (NVDA), Broadcom (AVGO), ASML (ASML), Micron (MU), Applied Materials (AMAT), and KLA-Tencor (KLAC) recently powered to new highs.

- Tech supergiants Apple (AAPL) and Google (GOOG) reached new all-time highs this week.

- The Nasdaq 100 (QQQ) – the “Dow Industrials of Tech” – reached a new all-time high this week.

- AI defense tech darling Palantir (PLTR) reached a new all-time high this week.

- Retail tech giant Shopify (SHOP) soared to a new all-time high this week.

- Data center infrastructure leader Vertiv (VRT) soared to a new all-time high this week.

Exponential technological progress is powering all these trends. After years of advancing at relatively modest rates, our computers are now exploding in power and speed. They are getting much more powerful, much faster, much smaller, and much cheaper.

The world is changing at the fastest pace we’ve ever seen… and that rate of change is speeding up every year. The rate of change we saw in the world 10 years ago is much faster than 20 years ago. The rate of change we saw in the world 5 years ago is much faster than 10 years ago. And yes, the rate of change we’re seeing now is much faster than the rate of change we saw 5 years ago.

Our world is like a car that has accelerated from 10 miles per hour to 50 miles per hour to 150 miles per hour.

I call this giant change to our world The Great Acceleration. It’s manifesting itself via booming tech company revenue and market value growth.

As you think about this boom and how you’re positioned, remember that Isaac Newton was right: An object in motion tends to stay in motion.

Trends tend to persist, and winners tend to keep on winning. I’m still long tech.

The Nasdaq 100 – the “Dow Industrials of Tech” – hits a new high

This High-Horsepower Indicator Is Flashing a Bright Green Light

Today, shares of Caterpillar (CAT) rallied 10% to reach an all-time high after reporting earnings. The construction-equipment maker said its revenue rose 10% to $17.64 billion, well ahead of analysts’ projection. The company said the latest figure set a record for the most revenue in any quarter.

Regular readers know what happens with Caterpillar is a big deal. In several recent issues, I’ve pointed to the all-time highs in Caterpillar as evidence that things “can’t be all that bad” with the U.S. economy.

Caterpillar is one of the world’s largest makers of heavy construction equipment. It makes bulldozers, dump trucks, excavators, generators, and skid loaders. Its fortunes rise and fall with the world’s ability to fund giant infrastructure, real estate, and transportation projects.

The price action of Caterpillar stock is one of my favorite economic indicators. By now, you know I place far more value on stock market prices than on economic forecasts. The excellent revenue guidance and fresh all-time high for one of the world’s most important manufacturing companies tells me that despite some negatives, the economy continues to power along.

It shows that “building things” is in a clear megatrend.

Show Cat’s all-time high to your local bear and ask them why they are right and the market is wrong.

Caterpillar’s new high says things can’t be all that bad

Are You Long Enough? Stocks Around the World Soar to New Highs

Above, I mentioned that the market is sending us a message that many technology sectors are in a rip-roaring super boom. But the market’s message gets even more bullish for stock investors…

As I write to you, our Global Trend Tracker shows new one-year highs for the ETFs we track for Canada (EWC), Taiwan (EWT), Spain (EWP), the UK (EWU), South Korea (EWY), Emerging Markets (EEM), Asia (AIA), Latin America (ILF), and Colombia (COLO).

Said another way, we are still in the confines of a broad global stock market boom.

Since the markets are up so much over the past few years, there’s no shortage of bears who say we’ve climbed too far… that a market apocalypse is ahead.

The bears may sound clever, but they are also wrong… as judged by the only judge that matters: the trend. The trend worldwide is one of higher stock prices.

I see this broad global stock market strength paired with the uptrend in U.S. stocks and think, “Sure, the global economy has issues… but there’s enough positives to power a global stock market boom. I guess the markets like tariff wars.”

Spain participates in the broad global stock market boom

Market Notes

- This week, the Engineering, Procurement, and Construction (EPC) theme continues to reward shareholders. Surging spending on data centers and power infrastructure just sent EPC firms Quanta (PWR), Primoris (PRIM), and Sterling Infrastructure (STRL) to new highs.

- The solar trade we’ve covered many times over the past three months is a winner this week. The Invesco Solar ETF (TAN) just hit a new 1-year high.